PSB ALLIANCE -DOORSTEP BANKING SERVICESBY PUBLIC SECTOR BANKS

Avail banking facilities sitting at home . Get cash at your home .

PSB ALLIANCE DOORSTEP BANKING SERVICES

NOW GET CASH AT YOUR DOORSTEP AND SUBMIT LIFE CERTIFICATE AT THE DOORSTEP :

Dated 08.12.2020 :

In the month of September 2020 , Door Step Banking ( DSB ) , an initiative taken by PSB Alliance and an umbrella setup of all Public Sector Banks , started their operation of servicing customers of public sector banks at their homes . It started its operations initially in non-financial services like delivery of cheque books , statement of accounts , demand drafts etc . Now the services are extended for cash withdrawal for the customers and submission of Life certificates ( for the pensioners ) in homes of the customers .

HOW IT WORKS ?

Customer of any Public Sector Bank can book Cash Withdrawal Service using DSB App / Web Portal or by calling on the Toll Free Number. The Bank Account of the Customer should be either linked to Aadhaar or Debit Card for availing real time Cash Withdrawal facility.

HOW TO AVAIL THE SERVICE BY USING DSB App / web portal ? 1. Download the app from Play Store and install in phone;

2. Register with your mobile number 3. An OTP will be sent to you.

4. Successful attempt with take you to Home page5. You create your profile by entering your name , e-mail address and the PIN .

6. once you have successfully created profile , you will get a welcome screen. 7. Select the bank from which you want to avail Doorstep Service

8.Enter your customer ID with the bank and proceed . 9 . You will get an OTP from your bank which you enter

10 . Screen will show you the accounts you have with the bank .11. Select the account for which you want to avail services .

12 . You can select cash transaction ( withdrawal ) or any of the other services like . a . Pay order b . Term deposit receipt c . cheque book . d Gift cheque e . Demand draft f. Demand Draft g . Account statement or Life certificate .

DSB Agent will visit your registered address for providing service through Micro ATM based secure technology. Per transaction limit is minimum Rs. 1,000/- and Maximum Rs 10,000/-

The Digital Life certificates will be issued by DSB Representative using Jeevan Praman App .

The service is available presently in limited number of centers .

To know whether it is available in your place ,

Dated 10.09.2020 : Union Minister of Finance & Corporate Affairs Smt. Nirmala Sitharaman yesterday inaugurated Doorstep Banking Services by PSBs while participating in the awards ceremony to felicitate best performing banks on EASE Banking Reforms Index.

Door Step Banking is an initiative taken by PSB Alliance , an umbrella setup of all Public Sector Banks , through which customers can avail major Banking transaction services at their Door Step. It shall be implemented by Door Step Banking(DSB) agents in 100 major Centers across the Country for offering different financial as well as non financial services.

As part of the EASE Reforms of Government of India , Doorstep Banking Services is envisaged to provide convenience of banking services to the customers at their door step through the universal touch points of Call Centre, Web Portal or Mobile App. Customers can also track their service request through these channels.

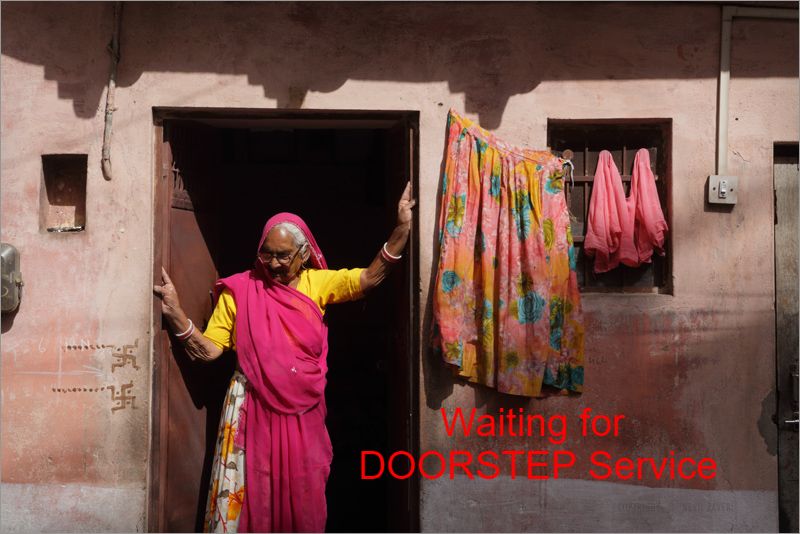

The services can be availed by customers of Public Sector Banks at nominal charges. The services shall benefit all customers, particularly Senior Citizens and Divyangs who would find it at ease to avail these services.

DOORSTEP BANKING FOR SENIOR CITIZENS :

Because of the spread of pandemic Covid -19 , Government of India has issued advisory to senior citizens , especially of age 65 years and above , to not to venture out of their homes unless it is necessary . Further most of the pensioners and retirees have to visit their bank branches to withdraw their pensions , update their passbook etc on regular basis . Most of the government pensions are routed through Public sector bank branches . Hence the services provided by Doorstep banking services on behalf of public sector banks are most useful to Senior citizens , retirees and pensioners . Now the cash delivery service has become operational which is boon to all senior citizens .

WHO CAN USE PSB ALLIANCE DOORSEP BANKING SERVICES

Any customer of 12 public sector member banks WHAT ARE THE SERVICES AVAILABLE NOW ?

The services include:

Pick-up of documents from customer:

1 Negotiable Instruments (Cheque/Draft/Pay Order Etc.)

2 New Cheque Book Requisition Slip

3 15G/15H Forms

4 IT/ GST Challan

5 Standing Instructions Request

6 RTGS/NEFT Fund Transfer request

7 Pick-up of Nomination form

8 Pick-up of account opening/application forms

9 Pick-up of other documents as specified by the Bank

Delivery of documents to customer:

- Account Statement

- Non-Personalized Cheque Book Draft, Pay Order

- Term Deposit Receipt, Acknowledgement etc.

- TDS/Form16 Certificate Issuance

- Pre-Paid Instrument/Gift Card

- Delivery of account opening/application/ forms

- Delivery of locker agreements

- Delivery of other documents as specified by the Bank

Financial /Other services

- Digital Life Certificate for Pensioners

- Cash deposit

- Cash withdrawal

MEMBER BANKS FOR PSB ALLIANCE DOORSTEP BANKING SERVICES

1. Bank Of Baroda ✓ ✓2. Bank Of India ✓ ✓3. Bank of Maharashtra ✓ 4. Canara Bank ✓ ✓5. Central Bank of india ✓ ✓6. Indian Bank ✓ 7. Indian Overseas Bank ✓ ✓8. Punjab National Bank ✓ ✓9. Punjab and Sind Bank ✓ ✓10. State Bank Of India ✓ ✓11. UCO Bank ✓ ✓12. Union Bank of India ✓

LIST OF CENTERS WHERE DOORSTEP SERVICES ARE AVAILABLE NOW :

Presently available in 100 centers across India

To know whether it is available in your place , CLICK HERE and go to List of Centres

HOW TO GET DOORSTEP BANKING APP ?

The DOORSTEP BANKING ( DBS ) app by Atyati Technolgies Pvt Limited ) Or PSBDSB by Integra Microsystem is available on the Google Play Store of Android phones

HOW TO GET STARTED ON DOORSTEP BANKING SERVICES ?

1. Download the app from Play Store and install in phone;2. Register with your mobile number 3. An OTP will be sent to you.4. Successful attempt with take you to Home page5. You create your profile by entering your name , e-mail address and the PIN .6. once you have successfully created profile , you will get a welcome screen. 7. Select the bank from which you want to avail Doorstep Service 8.Enter your customer ID with the bank and proceed . 9 . You will get an OTP from your bank which you enter 10 . Screen will show you the accounts you have with the bank .11. Select the account for which you want to avail services .12 . You can select which of the following you want to be delivered to you : a . Pay order b . Term deposit receipt c . cheque book . d Gift cheque e . Demand draft f. Demand Draft g . Account statement

OR FOLLOWING ITEMS WHICH ARE TO BE PICKED FROM YOU : a . 15G/ 15H b . cheque requisition . c . Demand Draft d . Cheque e . Pay order f : Standing instruction

PRECAUTIONS WHILE TAKING DBS SERVICE :

LINK YOUR MOBILE TO YOUR ACCOUNT BEFORE AVAILING THE SERVICE

IDENTIFY THE DSB AGENT : Authorized DSB Agents are provided with a Photo ID Card and Dress code. Besides, after successful Service Request initiation a common Service Code will be generated for the Customer and assigned DSB Agent. Before handing over the Instruments, customer can check the Service code with the DSB Agent.

Once the DSB Agent collects the instruments, he will Click “DOCUMENT COLLECTED” icon in his Device/Mobile App and all the Service Request placed will be automatically flow to the designated Bank Branch portal.

CROSS THE INSTRUMENT BEFORE HANDING OVER : You can deposit multiple Instruments at a time for collection using a single PAY-in-SLIP. However, before handing over any such Instruments, please ensure that all the Instruments are CROSSED (A/C PAYEE), Drawee Bank/Branch is different from your Home Branch. In case of TRANSFER Cheques (within the Home Branch), a separate PAY-in-SLIP has to be used.

HAND OVER IN A CLOSED ENVELOP : You should handover the Instrument(s) along with the Pay-in-Slip in a sealed ENVELOP for operational convenience and security. You can write no of instrument, your Bank Branch name and your name on the face of the Envelop.

DISCLAIMER

Use of the information at this site www.plannprogress.com is at one’s own risk. We do not offer to sell or solicit to buy any financial instruments including Deposits , Loans whether short term or otherwise , Mortgages , Stocks , Insurance or Mutual Funds .This site does not offer to sell or solicitation to buy any securities and we will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein are purely for educational purposes and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice.

Entry to this site is free of charge and we do not charge any fees what so ever . No need for registration for viewing the site . All content and information is provided on an ‘As Is’ basis by us. Information herein is believed to be reliable, but does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. As a condition to accessing http://www.plannprogress.com content and website, you agree to our Terms and Conditions of Use, Privacy policy & Disclaimer available on the links . The performance data quoted represents past performance and does not guarantee future results.

Articles/ Pages in this site contain advertisements and links to various third party sites / blogs as we have found articles therein interesting and useful and we believe reliable . Those links sites and advertisements may contain offer of sales or services of various kinds including financial services . We accept no responsibility for the accuracy , correctness and/or completeness of any information contained therein as we have not independently verified. The links and third party advertisements are governed by the privacy policy of those third party sites / blogs. We do not warrant or guarantee for any services or sales utilized therein . This site expressly disclaims all warranties and conditions of any kind, whether express or implied. However readers are advised to exercise their discretion in utilising / following any advice contained therein or utilizing any services or accepting their sales or any other offers and we do not take any responsibility what so ever.

The site is governed by Indian Laws and comes within the jurisdiction of courts in Mysuru , Karnataka , India

Contact Information : The site www.plannprogress.com is owned and operated by Mr . Manjunathan B.N. , No 37, 5thBlock , Madhuvana Layout , Sriramapura 2nd stage , Mysuru 570023 , Karnataka , India and can be contacted at email : info@plannprogress.com

Copyright © PlannProgress – All Rights are Reserved | Powered by PixelFlare

This website uses cookies to provide necessary site functionality and to improve your experience. By using this website, you agree to our use of cookies.