LATEST NEWS PERTAINING TO INDIAN OVERSEAS BANK ( IOB )

IOB’S Q3 RESULTS ANNOUNCED : STRONGEST PERFORMANCE

Dated 14.01.2026: Indian Overseas Bank (IOB) announced its financial results for the third quarter (Q3 FY 2025-26) ending December 31, 2025, earlier today, January 14, 2026.

The bank reported its strongest quarterly performance to date, characterized by a massive surge in profit and a significant improvement in asset quality.

Financial Performance Highlights

- Net Profit: Surged by 56.25% year-on-year (YoY) to ₹1,365.12 crore, compared to ₹873.66 crore in the same quarter last year.

- Net Interest Income (NII): Increased by 18% YoY to ₹3,298.5 crore, up from ₹2,789 crore.

- Operating Profit: Grew by 14.87% to reach ₹2,603 crore.

- Return on Assets (RoA): Improved to 1.28% (annualized), up from 0.93% in Q3 last year.

- Return on Equity (RoE): Strengthened to 20.98%.

Asset Quality (Major Improvement)

IOB continued its trend of cleaning up its balance sheet, with NPAs reaching multi-year lows:

- Gross NPA Ratio: Improved to 1.54% (compared to 1.83% in the previous quarter and 2.55% a year ago).

- Net NPA Ratio: Drobed to 0.24% (compared to 0.28% in the previous quarter and 0.42% a year ago).

- Provision Coverage Ratio (PCR): Maintained at a robust 97.49%.

Business Growth & Capital

- Total Business: Expanded by 18.71% YoY to reach ₹6.44 lakh crore.

- Total Deposits: Stood at ₹3,49,302 crore (up 14.5% YoY).

- Total Advances: Rose to ₹2,94,974 crore (up 24.1% YoY), led by strong growth in retail, agriculture, and MSME (RAM) segments.

- Capital Adequacy Ratio (CRAR): Stood at 16.30% under Basel III norms

Market Reaction

Following the announcement, IOB shares saw positive momentum, surging approximately 4% during today’s trading session

——————————————————————————–

GOVERNMENT TO SELL 3 % STAKE IN INDIAN OVERSEAS BANK ( IOB )

You can apply for purchase tomorrow

Dated 17.12.2025 : The Government of India has launched an Offer for Sale (OFS) to sell up to a 3% stake in Indian Overseas Bank (IOB). The sale is taking place today, Wednesday, December 17, 2025, and tomorrow, December 18.

This move is part of the government’s effort to meet SEBI’s Minimum Public Shareholding (MPS) requirement, which mandates that public sector banks reduce government holding to 75% or less.

Key Details of the Stake Sale

Feature | Details |

Offer Period | Dec 17 (Today): For Non-Retail (Institutional) Investors Dec 18 (Tomorrow): For Retail Investors & Employees |

Base Offer Size | 2% (38,51,31,796 shares) |

Green Shoe Option | Additional 1% (19,25,65,898 shares) if oversubscribed |

Total Stake Sale | Up to 3% (approx. 57.77 crore shares) |

Floor Price | ₹34.00 per share |

Estimated Value | Approx. ₹1,964 crore to ₹2,100 crore |

Broker to Offer | Goldman Sachs (India) Securities Pvt Ltd |

Important Investor Information

- Pricing: The floor price of ₹34.00 is roughly a 7% discount to yesterday’s closing price of ₹36.55.

- Retail Category: 10% of the offer is reserved for retail investors. Retail investors can place bids tomorrow (Thursday).

- Employee Reservation: Up to 1.5 lakh shares are reserved for eligible employees, who can apply for shares worth up to ₹5 lakh.

- Market Impact: IOB shares were trading down approximately 3-4% earlier today (around ₹35.00–₹35.40) as the market reacted to the discounted floor price.

- Current Holding: Before this sale, the Government of India held a 94.61% stake in IOB.

How to apply for OFS ?

To participate in the Indian Overseas Bank (IOB) Offer for Sale (OFS), you will need to act tomorrow, Thursday, December 18, 2025, as today is reserved for large institutional investors

1. When to Apply

- Date: Thursday, December 18, 2025.

- Time: Usually between 9:15 AM and 3:30 PM (check your broker’s specific cut-off, as some close at 2:30 PM or 3:00 PM).

2. Where to Apply (Online)

You can participate through your existing Demat/Trading account (e.g., Zerodha, ICICI Direct, HDFC Securities, SBI Securities, Upstox, etc.).

- Login to your broker’s mobile app or web portal.

- Look for a section named “OFS”, “Offer for Sale”, or “Corporate Actions”. It is often located near the “IPO” or “Bids” section.

- Select Indian Overseas Bank (IOB) from the list of active offers.

3. How to Fill the Bid

- Category: Select “Retail”.

- Quantity: Enter the number of shares you wish to buy.

- Note: As a retail investor, your total investment cannot exceed ₹2 Lakh.

- Price: You have two choices:

- Cut-off Price (Recommended): By selecting “Cut-off,” you agree to buy the shares at the final discovered price. This significantly increases your chances of getting an allotment.

- Specific Bid: You can enter a price at or above the floor price (₹34.00). However, if your bid is too low compared to others, you may not get any shares.

- Funds: Ensure you have the full amount (Quantity × Price) available in your trading account’s ledger/cash balance before placing the bid. Unlike an IPO, the money is usually debited upfront or immediately upon allotment.

4. Summary of Key Terms

Feature | Detail |

Floor Price | ₹34.00 |

Retail Limit | Up to ₹2,00,000 |

Retail Allotment | Based on “Price Priority” (higher bids get shares first). |

Discount | Retail investors often receive a slight discount (typically 5%) or can bid at the “Cut-off” price to ensure allotment. |

Note for Retired Employees : Retired Employees may not be eligible for Employees quota and hence better to apply as a retail investor

STRIKE DEFERRED IN INDIAN OVERSEAS BANK

Dated 29.11.2025 : All India Overseas Bank Employees’ Union ( AIOBEU ) , the leading trade union of IOB staff members had given a call to its members to participate in a two days all India strike on December 1 & 2, 2025 pressing for implementation of their various demands .

To discuss the demands made by the union , The Deputy Chief Labour Commissioner (Central) held meeting , through video conferencing, with the Deputy Chief Labour Commissioner (HQ), Delhi, the Deputy Secretary, DFS, and the General Manager (HR). bank along with the union representative .

The next round of the the conciliation meeting is fixed on 11.12.2025. In view of the developments and on the advice of DCLC , Union has agreed to defer the Strike Action until 11.12.2025, the next date of conciliation.

STRIKE CALL IN INDIAN OVERSEAS BANK

Dated 11.11.2025 : All India Overseas Bank Employees’ Union ( AIOBEU ) , the leading trade union of IOB staff members has given a call to its members to participate in a two days all India strike on December 1 & 2, 2025 .

The union is demanding :

- Expedite Compassionate Appointments.

- Increase in CSA Recruitment Indent to match Branch Requirements and Branch Expansions.

- Immediate initiation of recrutment of Office Assistants.

- Immediate initiation of recruitment of Armed Guards.

- Immediate Release of Staff Welfare Benefits.

- Implementation of Special Customer Service Associate se lement.

- Immediate consideration of long pending Inter-Region Transfer Requests.

- Posting of Customer Service Associates in Administrative Offices, RLPC’s etc for undertaking work as defined in XII Bipartite Settlement.

- Uniform and fair transfer policy for workmen through bilateral discussion.

- Enabling Overtime Claims in Chris 3 portal.

- Re-designation of all Part Time Sweepers as Messengers as per the Memorandum of Settlement with the Union.

- One me Transfer op on for employees in reorganized regions.

- Payment of Bonus to Temporary / Outsourced Employees.

IOB TO ACCEPT PAYMENT OF PREMIUM WITHOUT GST

For THE NEW MEDICAL INSURANCE SCHEME 2025-26

Dated 23.10.2025 : As per the interim Stay order passed in a Writ Petition by the honourable high court of Kerala, Indian Overseas Bank has decided to collect the renewal Premium for Retirees’ medical insurance for the year 2025-26 without adding GST @ 18% .

This stay order is subject to further orders to be passed by the Honourable Court.

The GST amount for already paid by the Retirees, will be refunded to their account on or before 05.11.2025.

The last date for renewing the insurance is 27th October 2025

IOB EXTENDS THE LAST DATE for payment of premium

THE NEW MEDICAL INSURANCE SCHEME 2025-26 FOR RETIREES POLICY PERIOD 01.11.2025 TO 3l.10.2026 .

Dated 22.10.2025 : Indian Overseas Bank today extended the last date for online renewal of the IBA GROUP INSURANCE POLICY from existing 23.10.2025 to 27.10.2025 . Now the renewal premium can be paid by the retirees online up to the Monday 27th , October 2025

IOB Retirees get stay order on paying GST on the renewal of

THE NEW MEDICAL INSURANCE SCHEME 2025-26 FOR RETIREES POLICY PERIOD 01.11.2025 TO 3l.10.2026 .

Dated 17 .10.2025 : It’s reported that the High Court of Kerala has stayed the collection of GST @ 18% on the premium payable towards renewal of the health insurance policy of retirees/family pensioners of Indian Overseas Bank for the policy year 2025–26, pending disposal of a writ petition filed by ASSOCIATION OF RETIRED IOB’S EMPLOYEES and others . Official circular from Indian Overseas Bank is awaited .

The last date for paying the renewal premium in IOB is 23.10.2025

IOB Retirees can now pay Premium for

THE NEW MEDICAL INSURANCE SCHEME 2025-26 FOR RETIREES POLICY PERIOD 01.11.2025 TO 3l.10.2026 . LOAN IS AVAILABLE FOR PAYMENT OF PREMIUM

Dated 08.10.2025 : Indian Overseas Bank has announced the New Medical Insurance Scheme for officers/employees effective from 01.10.2015 for Working employees and 01.11.2015 for Retired Employees as per the Xth Bipartite Settlement. . For the current year, IBA has advised, that for the succeeding policy, both Serving employees and Retired Employees’ Policy will start from 01.11.2025.

Conditions for Policy & Premium Payment:

The general conditions of the policy will be as per the scheme announced by IBA ( Click here to know the details of premium and terms conditions agreed by IBA . )

For Retirees, both Base and Top up policy premium is to be fully borne by the Retired employees including October 2025 retirees. It is only optional on the part of retired/retiring employees to continue .

- Retiree Base Policy – The Retirees’ Base Policy period is from .1st Nov, 2025 to 31st Oct, 2026.

- Coverage of Members under Retirees policy:

1) Single Person* (Self or Surviving Spouse)

2) Self + Spouse (Family)

3) Add-On: With additional Premium, Mentally/physically challenged Dependent family members (Son/ Daughter only) can be included by·way of add-on. Additional Premium per dependent for the same is to be paid by the Retiree.

4 ) Single Person cover is also available for Retirees; the following cases are eligible to opt for Single person policy:

(i) Where a Retiree does not have a surviving spouse.

(ii) Where Retiree is survived by the spouse (Retiree has passed away)

(iIi) Where retiree does not require the insurance cover for the spouse.

(IV) The Retiree may opt for single person cover, even if the spouse is alive.

(v ) Last date for payment of premium is 23.10.2025

(VI) The premium to be paid will be along with 18 % GST on the premium amount

Loan for Medical Premium Payment: :

Retirees who wish to avail loan for payment of premium may avail . Loan will be disbursed upon submission of premium receipt. Any existing loan outstanding availed last year for the same purpose should have been closed before availing the new loan. The loan can be granted till 15.11.2025. This loan is in addition to the existing Pension Loan scheme subject to 40% norms. Cut-off date for availing loan for payment of premium Mediclaim· policy will be 15.11.2025.

How to make premium payment ?

Retirees can log in to Retirees’ portal by clicking here

- Login with Roll number and Date of Birth as user id and password, for Pensioner/Family Pensioner.

- After logging into the portal, Click on the menu “Medical Insurance Premium”.

- Select the option Base Policy/ Base + Top up Policy with required Sum Insured for Single Policy or Self+Spouse (Family Floater) with Dependent option (Yes/No).

- If Yes, Proof of Disability of Dependent children to be uploaded as pdf file (File size < 2mb).

- Submit and click on the button “Proceed to Payment” to complete the premium payment process.

For Non-Pensioners – PF Optees & their Spouses:

The retired employees or the spouse of the deceased employees who were not pension optees, wish to join or renew the Medical Insurance can send a mail to padwelfare@iob.in for creating a login for payment of insurance premium.

The following details are to be furnished in the email.

1) Name:

2) Roll No.:

3) Mob No.:

4) Email ID:

5) SB A/C No.:

(SB A/c no. should be mandatorily attached to Roll no. of staff, other account numbers are not allowed)

Online Payment:

- Select the online payment options such as

- a) Net Banking – For Self Payment

- b) Account debit. (Batch Process by CO)

- On successful payment, reference number will be created and receipt will be shown for corresponding Online payment.

- In case of Payment Awaited status, retry the payment after 30 minutes.

(For Account Debit option “Awaited Status will change only on the Next Working day).

FINANCIAL RESULTS OF IOB FOR THE QUARTER ENDED 30TH SEPTEMBER 2025 :

IMPRESSIVE PERFORMANCE

Dated 16.10.2025 : The financial results for Indian Overseas Bank (IOB) for the quarter ending September 30, 2025 (Q2 FY 2025-26), were announced today, October 16, 2025.

Here are the key highlights from the Unaudited (Reviewed) Financial Results (Standalone):

- Net Profit: The bank reported a significant jump in Net Profit, which increased by approximately 58% year-on-year (YoY) to ₹1,226.42 crore (from ₹777.16 crore in Q2 FY 2024-25).

- Asset Quality: There was a marked improvement in asset quality:

- Gross Non-Performing Assets (GNPA) Ratio improved to 1.83% (from 2.72% in the year-ago quarter).

- Net Non-Performing Assets (NNPA) Ratio improved to 0.28% (from 0.47%ailin the year-ago quarter).

- Interest Income: The bank’s Interest Income rose to ₹5,856 crore in Q2 FY’26, up from ₹5,055 crore in the same quarter of the previous fiscal.

- Capital Adequacy: The Capital Adequacy Ratio (Basel III) stood at 17.94%.

- Return on Assets (Annualised): The Return on Assets (Annualised) was 1.20%.

The bank’s Board of Directors approved these results in a meeting held today.

FINANCIAL RESULTS OF IOB FOR THE QUARTER ENDED 30TH JUNE 2025 :

IMPRESSIVE PERFORMANCE

Dated 18.07.2025 : Public sector lender Indian Overseas Bank has today come out with financial results for the quarter ending 30th, June 2025 and the results indicate an impressive performance .

The highlights of the performance as per Press release issued by the bank today are :

- IOB’s Net Profit jumps to historic high of ₹ 1,111 Cr registering Y-o-Y growth of 75.57 %

- Net Profit up by 75.57 % to ₹ 1,111 crore

- Operating profit increased by 40.70 % to ₹ 2,358 crore

- Net Interest Income increased by 12.50 % to ₹ 2,746 crore

- Net Interest Margin (NIM) stood at 3.04 % as on 30.06.2025

- Cost to Income Ratio improved by 754 bps to 44.22 %

- Return on Assets (ROA) improved by 44 bps to 1.14 %

- Return on Equity (RoE) improved by 490 bps to 19.00 %

- Total Business grew by 12.19 % to ₹ 5,93,213 crore

- Total Deposits up by 10.75 % to ₹ 3,30,792 crore

- CASA deposits increased by 15 % to ₹ 1,44, 837 crore

- CASA Ratio improved by 161 bps to 43.78 % as on 30.06.2025

- Gross Advances increased by 14.05 % to ₹ 2,62,421 crore

- CD Ratio increased to 79.33% as on 30.06.2025

- Gross NPA improved by 92 bps to 1.97 % as on 30.06.2025

- Net NPA improved by 19 bps to 0.32 % as on 30.06.2025

- Slippage ratio improved by 3 bps to 0.10 % as on 30.06.2025

- Credit Cost stood at 0.29 % as on 30.06.2025

- Total Recovery increased by 46.13 % to ₹ 851 crore

- Provision Coverage Ratio improved by 51 bps to 97.47 %

- CRAR improved by 46 bps to 18.28 % as on 30.06.2025

To read complete press release , CLICK HERE

FIXED DEPOSIT INTEREST RATES REVISED AGAIN :

Dated 15.07.2025 : The public sector bank , Indian Overseas Bank , has reduced the interest rates on fixed deposits of various maturities effective today with effect from 15th, JuLY 2025 .

The new rates for domestic and NROs are :

7-14 Days – 3.50 ( Earlier 4.00 )

15-29 Days -3.50 ( Earlier 4.00 )

30-45 Days-3.50 ( Earlier 4.00 )

46-60 Days- 4.00 ( Earlier 4.00 )

61-90 Days -3.50 ( Earlier 3.50 )

91-120 Days -4.00 ( Earlier 4.00 )

121-179 Days- 4.00 ( Earlier 4.00 )

180-269 Days -5.00 ( Earlier 5.00 )

270 Days to < 1 Year -5.50 ( Earlier 5.50 )

1 Year to < 2 Years(Except 444 Days) – 6.60 % ( Earlier 6.70 )

444 Days – 6.75 % ( Earlier 6.95 )

2 Years to < 3 Years -6.60( Earlier 6.60 )

3 Years and Above -6.30 ( Earlier 6.30 )

* Minimum Amount Rs. 1.00 Lakh

*Interest Rate of 7.10% for 444 days bucket is valid till 30.06.2025.

Interest Rate for IOB Tax Saver Deposit will remain unchanged at 6.30%.

For Senior Citizens (aged 60 Years and above), Additional interest rate of 0.50% and for Super Senior Citizens (aged 80 years and above), Additional interest rate of 0.75% continues.

For Retired Staff, the Applicable interest rate will continue to be governed by the decision taken by ALCO in its meeting No-04/2019-20 held on 08.07.2019.

The revised Interest rates on NRE Term Deposits w.e.f. 15.07.2025 are as follows:

NRE DEPOSIT INTERESTS :

1 Year to < 2 Years (Except 444 Days) -6.60 %

444 Days 6.75 %

2 Years to < 3 Years =6.60 %

3 Years and Above 6.30 %

FINANCIAL RESULTS OF IOB FOR THE QUARTER AND YEAR ENDED 31ST MARCH 2025

Dated 02.05.2025 : Public sector lender Indian Overseas Bank has today come out with financial results for the quarter ending 31st, March 2025 as well as Financial year FY 2024-25 and the results indicate an impressive performance .

The highlights of the performance as per Press release issued by the bank today are

(QUARTER ENDED 31.03.2025 OVER 31.03.2024 & 31.12.2024)

- IOB hits historic high: Quarterly profit Crosses Rs 1000 Cr mark registering Y-o-Y growth of 30.07 %

2.Net Profit increased to ₹1,051 Crore for the Q4FY25 from ₹808 Crore for the Q4FY24, registering a growth of ₹243 Crore at 30.07% Y-o-Y basis. The same is increased by 20.25 % on a Q-o-Q sequential basis.

- Operating Profit increased to ₹2,618 Crore for Q4FY25 from ₹1,961 Crore for Q4FY24, registering a growth of ₹657 Crore at 33.50% Y-o-Y basis. The same is increased by 15.53 % on a Q-o-Q sequential basis.

- Net Interest Income (NII) increased by 13.03% to ₹3,123 Crore for Q4FY25 from ₹2,763 Crore for Q4FY24. The same is increased by 11.98 % on a Q-o-Q sequential basis.

- Cost to Income Ratio improved to 44.35% for Q4FY25 as against 62.58% for Q4FY24. The same was 44.55 % for the quarter ended 31.12.2024.

- Return on Assets (ROA) improved to 1.12 % for Q4FY25 as against 0.94% for 4FY24.

- Return on Equity (ROE) improved to19.53% for Q4FY25 as against 18.50% for Q4FY24.

- Net interest Margin (NIM)- Domestic improved to 3.77 % for Q4FY25 as against 3.73 % for Q4FY24. The same was 3.47 % as on 31.12.2024

- Net interest Margin (NIM)- Global improved to 3.58 % for Q4FY25 as against 3.53 % for Q4FY24. The same was 3.33 % as on 31.12.2024

- Net Profit increased by 25.56 % to ₹3,335 Crore for the year ended 31.03.2025 as against ₹2,656 crore for the year ended 31.03.2024.

- Operating Profit has shown a growth of 28.44 % to ₹8,688 crore for the year ended 31.03.2025 as against ₹ 6,764 crore for the year ended 31.03.2024.

- Net Interest Income (NII) increased by 10.79 % on Y-o-Y basis to ₹ 10,890 crore for the year ended 31.03.2025 as against ₹ 9,829 crore for the year ended 31.03.2024

- Cost to Income Ratio improved at 47.14 % for the year ended 31.03.2025 as against 56.32 % for the year ended 31.03.2024.

- Return on Assets (ROA) improved to 0.92 % for the year ended 31.03.2025 against 0.81 % for the year ended 31.03.2024.

- Return on Equity (ROE) stood at 16.28 % for the year ended 31.03.2025.

To read the Press release , CLICK HERE

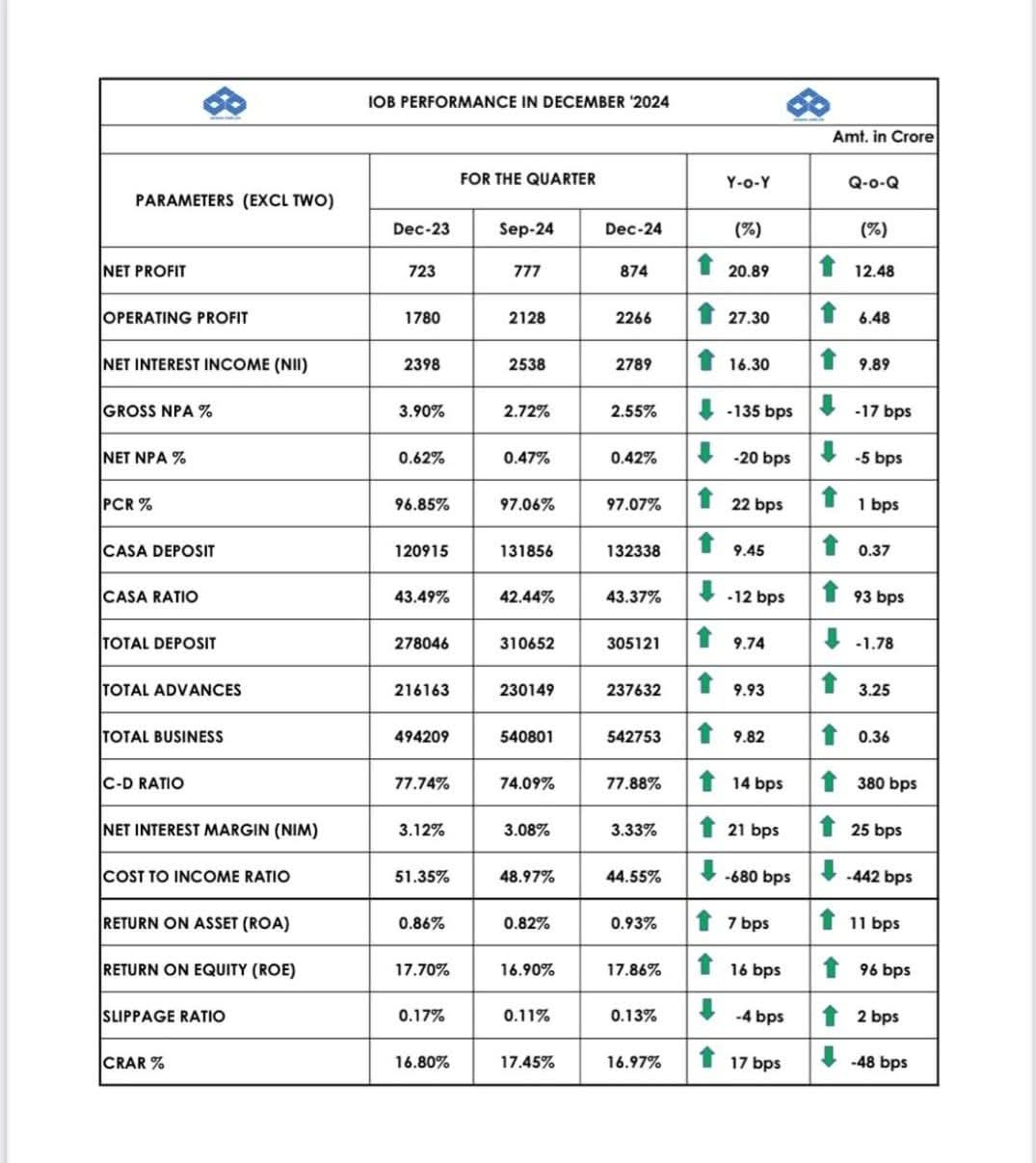

Unaudited Financial Results Q3 – 2024-25 NET PROFIT GROWS BY 23.68 %

Dated 20.01.2025: Indian Overseas Bank has announced its Unaudited Financial Results for the Third quarter of the Financial year 2024-25 .

Some of the key performance results for the quarter October 2024 to December 2024 are : ( Figures in Rs crores )

1. Net Interest Income : 2,7892. Operating Profit : 2,266

3. Net Profit : 8744. Net NPA : 1,059

The Net profit increased from Rs 774 crores in September 2024 to Rs 874 crores as of 31.12.2024, growing by 23.68 % from December 2023 to December 2024 .

For the total picture of the announcement , CLICK HERE

IOB RECEIVES ORDER OF REFUND AGAIN FROM THE INCOME TAX DEPARTMENT

Dated 12.12.2024 : The public sector lender Indian Overseas Bank has informed the BSE and NSE that they have received an order of Tax refund . As per the order dated 17.08.2024, the amount refundable to the Bank for the AY 2015-16 including interest u/s 244A of the Income-tax Act is ₹1359,29,17,840/- (Rupees One Thousand Three Hundred and Fifty-Nine Crores Twenty-Nine Lakhs Seventeen Thousand Eight Hundred and Forty Only).

Further it’s reported in the media that the bank has informed that it is entitled to an income tax refund of Rs 808.30 crores for the Assessment year 2013-14 .

The Bank earlier on 25.11.2024 had received an order for a refundable amount of 1238,31,09,327/- for the AY 2019-20 including interest u/s 244A of the Income-tax Act . The bank had also had a refund of Rs 549.80 for the AY 2020-21 on 28.10.2024

To read the IOB’S LETTER TO BSE / NSE , CLICK HERE

IOB RECEIVES INCOME TAX REFUND OF RS 1238 CRORES

Dated 26.11.2024 : The public sector lender Indian Overseas Bank has informed the BSE and NSE that they have received an order by the income tax department for an income tax refund of Rs 1238.31 crores for the Financial year 2018-19 through income tax portal on 25.11.2024 .

The Bank has received the order under Section 250 of the Income Tax Act, 1961 . As per the order dated 19.08.2024, the amount refundable to the Bank for the AY 2019-20 including interest u/s 244A of the Income-tax Act is RS 1238,31,09,327/-

LIFE CERTIFICATE FOR IOB STAFF PENSIONER THROUGH MOBILE APP mCHRIS

Dated 02.11.2024 : Indian Overseas Bank has introduced the facility of submitting Life Certificates for its staff pensioners through the mobile App IOBians mCHRIS . The app can be downloaded from Google Playstore .

After downloading , one has to login to the app exemployee by feeding Roll number , date of birth and the OTP received on the linked mobile . Go to Life certificate section , allow the photo to be taken and the life certificate will be generated .

With the help of this, 10B Staff Pensioners will have the option to submit their life certificate digitally within few minutes , sitting at home without visiting the branches.

The pensioners complying with the following prerequisites can only utilize mCHRIS opp for submission of life certificate.

To utilize the facility , pensioners have to comply with the following conditions.

1. The mobile number of the pensioner must be linked with the pensioner’s savings account for accessing the mCHRIS opp.

2. The pensioner should be physically present in India during the submission

3. The Aadhar number and PAN of the pensioner must be linked with the pensioner’s savings account.

4. Once the Life certificate is submitted digitally, there is no need for pensioner’s to submit it in any physical form.

Unaudited Financial Results Q2 – 2024-25

NET PROFIT ZOOMS BY 24.32 %

Dated 24.10.2024 : Indian Overseas Bank has announced its Unaudited Financial Results for the Second quarter of the Financial year 2024-25 .

Some of the key performance results are : ( Figures in Rs crores )

1. Net Interest Income : 2,5382. Operating Profit : 2, 128

3. Net Profit : 777 4. Net NPA : 1,059

For the complete report published by the bank , CLICK HERE

Unaudited Financial Results Q1 – 2024-25 NET PROFIT ZOOMS BY 26.5 %

Dated 22.07.2024 : Indian Overseas Bank today announced its Unaudited Financial results for the First quarter of the Financial year 2024-25 .

Some of the key performance results are

Figures in Rs Lakhs

1. Interest Income : 24,04,973

2. Operating Profit : 676,3763. Net Profit : 265,561

4. Net NPA : 121,6865. Net worth : 18,06,918

FIXED DEPOSIT INTEREST RATES REVISED :

Dated 16.07.2024 : The public sector bank , Indian Overseas Bank , has announced the new interest rates on fixed deposits with effect from 15th, July 2024 . Now the deposits in the maturity bracket of 1 year to 2 years ( except 444 days ) carry an interest rate of 7.10 % pa , enhanced from the existing 6.90 % pa . Interest rates for all other periods kept unchanged .

The new rates effective from 15th , July 2024 for domestic and NROs are

7-14 Days* 4.00

15-29 Days 4.5030-45 Days 4.50

46-60 Days 4.50

61-90 Days 4.2591-120 Days 4.75

121-179 Days 4.25

180-269 Days 5.75270 Days to < 1 Year 5.75

1 Year to < 2 Years

(Except 444 Days) 7.10444 Days 7.30

2 Years to < 3 Years 6.803 Years and Above 6.50

* Minimum Amount Rs. 1.00 Lakh

Interest Rate for IOB Tax Saver Deposit will remain unchanged at 6.50%.

For Senior Citizens (aged 60 Years and above), Additional interest rate of 0.50% and for Super Senior Citizens (aged 80 years and above), Additional interest rate of 0.75% continues.

For Retired Staff, Applicable interest rate will continue to be governed by the decision taken by ALCO in its meeting No-04/2019-20 held on 08.07.2019.

The Revised Interest Rates on NRE Term Deposits w.e.f 15.07.2024 are as Follows

1 Year to < 2 Years (Except 444 Days) 7.10 %444 Days 7.30 %

2 Years to < 3 Years 6.80 %3 Years and Above 6.50 %

IOB RATE CARD

Financial Results FY 2023-24 NET PROFIT ZOOMS BY 26.5 %

Dated 09.05.2024 : Indian Overseas Bank today announced its Financial results for the Financial year 2023-24 . The operating profit and Net profits for FY 2023-24 of Public sector lender raised by 13.8 % and 26.5 % respectively compared with results of FY 2022-23 .

Some of the key performance results for FY 2023-24 are

( In brackets figures for FY 2022-23 ) Figures in Rs Lakhs

1. Interest Income : 24,04,973 ( 19,40,033 )

2. Operating Profit : 676,376 ( 594,218 ) 3. Net Profit : 265,561 ( 209,879 )

4. Net NPA : 121,686 ( 326,601 )5. Net worth : 18,06,918 ( 14,64, 349 )

To read press release of IOB , CLICK HERE

NOW IOB CUSTOMERS CAN TRANSFER THEIR SB ACCOUNTS ON-LINE :

Dated 02.01.2024 : The public sector bank , Indian Overseas Bank , has now provided on-line facility to its customers for transfer of their Savings Bank Accounts to any branch of their choice hassle-free .

Some customers need their account transfer from one branch to the another as they would have shifted their residence or business / working spot from one town to the another . Normally they have to give applications to either of the branches and wait for the transfer . Now customers can visit IOB on-line , fill their account number and captcha . An OTP will be sent to the registered mobile number of the customer . On entering the OTP , you can further furnish the branch where the account to be transferred

IOB LAUNCHES REVAMPED WEBSITE :

Dated 17.05.2023 : Public sector Lender Indian Overseas Bank has recently launched its new revamped website .

It has got new features like Internet banking log in option in the top of the home page, ready access to all customer care requirements, Apply for loans options, open SB account option , EMI calculator option, key words for instant search and many other important features in the home page itself.

It’s expected that the new website will be useful for easy navigation to both the existing customers and would be customers

INDIAN OVERSEAS BANK IS OUT OF PCA FRAMEWORK

Dated 30.09.2021 : Reserve Bank of India ( RBI ) yesterday announced through a press release , that it has been decided to take out Indian Overseas Bank from the PCA framework ( Prompt Corrective Action Framework ) , subject to certain conditions and continuous monitoring.

Matter was reviewed by the Board for Financial Supervision (BFS) in its meeting . It was noted that as per its published results for the year ended March 31, 2021, the bank is not in the breach of the PCA parameters. The bank has provided a written commitment that it would comply with the norms of Minimum Regulatory Capital, Net NPA and Leverage ratio on an ongoing basis and has apprised the RBI of the structural and systemic improvements that it has put in place which would help the bank in continuing to meet these commitments.

To read the press release of RBI , CLICK HERE

DISCLAIMER

Use of the information at this site www.plannprogress.com is at one’s own risk. We do not offer to sell or solicit to buy any financial instruments including Deposits , Loans whether short term or otherwise , Mortgages , Stocks , Insurance or Mutual Funds .This site does not offer to sell or solicitation to buy any securities and we will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein are purely for educational purposes and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice.

Entry to this site is free of charge and we do not charge any fees what so ever . No need for registration for viewing the site . All content and information is provided on an ‘As Is’ basis by us. Information herein is believed to be reliable, but does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. As a condition to accessing http://www.plannprogress.com content and website, you agree to our Terms and Conditions of Use, Privacy policy & Disclaimer available on the links . The performance data quoted represents past performance and does not guarantee future results.

Articles/ Pages in this site contain advertisements and links to various third party sites / blogs as we have found articles therein interesting and useful and we believe reliable . Those links sites and advertisements may contain offer of sales or services of various kinds including financial services . We accept no responsibility for the accuracy , correctness and/or completeness of any information contained therein as we have not independently verified. The links and third party advertisements are governed by the privacy policy of those third party sites / blogs. We do not warrant or guarantee for any services or sales utilized therein . This site expressly disclaims all warranties and conditions of any kind, whether express or implied. However readers are advised to exercise their discretion in utilising / following any advice contained therein or utilizing any services or accepting their sales or any other offers and we do not take any responsibility what so ever.

The site is governed by Indian Laws and comes within the jurisdiction of courts in Mysuru , Karnataka , India

Contact Information : The site www.plannprogress.com is owned and operated by Mr . Manjunathan B.N. , No 37, 5thBlock , Madhuvana Layout , Sriramapura 2nd stage , Mysuru 570023 , Karnataka , India and can be contacted at email : info@plannprogress.com

Copyright © PlannProgress – All Rights are Reserved | Powered by PixelFlare

This website uses cookies to provide necessary site functionality and to improve your experience. By using this website, you agree to our use of cookies.