IT RETURNS FOR FY 23-24 (AY 2024-25)

VALIDATE YOUR BANK ACCOUNT FOR SMOOTH REFUND

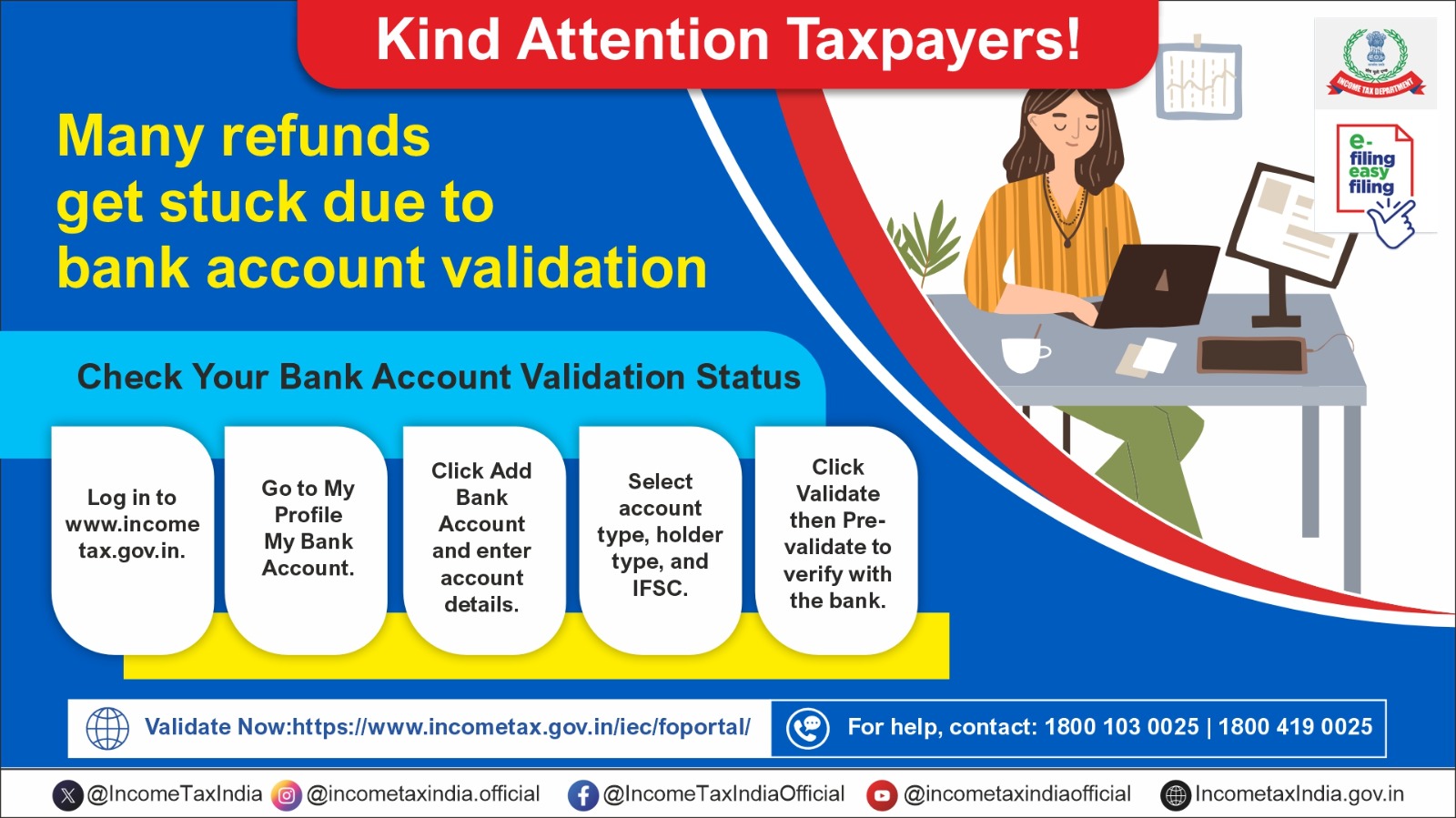

Dated 28.12.2024 : You would have submitted your income tax returns and you would be expecting refund from the income tax department . But if your bank account is not validated , the refund may be delayed and stuck up for want of bank account details . Please ensure corrected and validated bank account is recorded with the department .

To validate your bank account

1. Log in to e-filing website with your PAN Number and Pasword

2. Click on login where your name appears and go to ” My Profile ” 3. Go to ” My bank account “

4. If you have already validated bank account , it will show . Check whether the bank account is correct 5. Otherwise go to : Add bank account ”

6. Fill up all the details of the bank account you want to add . 7 . Validate the information filled .

NOTE :

Add a bank account which is linked with your PAN (bank account number must be linked with your PAN) to receive refund.

Refund can be issued in following account types: Savings, Current, Cash Credit, Over Draft & Non Resident Ordinary.

The Name as per PAN and Name in your bank account must match.

Refund cannot be issued to bank accounts which are closed, invalid, under litigation or in blocked status.

EVC can be enabled for Individual taxpayers only, for one validated bank account at any given time.

To Enable EVC, Mobile number or Email Id as in e-Filing user profile should match with the details linked with the bank account.

If there is any change in mobile number or email Id linked with bank, update the contact details in e-Filing user profile and then revalidate your added bank contact to get your updated contact details validated from bank.

EVC can be used for following: verifying income tax returns and other forms, e-Proceedings, refund reissue request, reset password and secured login to e-filing account.

EVC can be enabled for the bank accounts of following banks only

List of Banks

Bank of Baroda

Bank of MaharashtraDhanlaxmi Bank Ltd

RBL Bank LimitedThe Saraswat Cooperative Bank Ltd

IDFC FIRST BANK LIMITEDThe Cosmos Cooperative Bank Ltd

JANA SMALL FINANCE BANK LTDUCO Bank

Axis BankIndian Bank

IDBI LtdESAF SMALL FINANCE BANK LIMITED

South Indian BankIndian Overseas Bank

Karnataka Bank LtdCanara Bank

Central Bank of IndiaCity Union Bank Ltd

Federal Bank LtdHDFC Bank Ltd

ICICI Bank LtdEQUITAS SMALL FINANCE BANK LIMITED

Union Bank of IndiaPunjab National Bank

The Jammu and Kashmir BankKarur Vysya Bank

Kotak Mahindra BankState Bank of India

Kalupur Commercial Cooperative BankUTKARSH SMALL FINANCE BANK

The Banaskantha Mercantile Co-Operative BankAU SMALL FINANCE BANK LIMITED

LAST DATE FOR FILING BELATED IT RETURNS IS EXTENDED

Dated 01.01.2025 ; The last date for filing Income Tax returns for FY 2023-24 ( AY 2024-25 ) , belatedly with fine was 31st , December 2024 .

Now The Central Board of Direct Taxes (‘the CBDT’), has extended the last date for furnishing belated return of income under sub-section (4) of section 139 of the Act or for furnishing revised return of income under sub-section (5) of section 139 of the Act for the Assessment Year 2024-25 in the case of resident individuals from 31 st December, 2024 to 15th January, 2025.

If you have failed to furnish the return of income within the due date, you may pay Rs. 5000 as late fee and submit the return on or before 15th January 2025 . However, if your total income does not exceed Rs. 5 lakh, the fee payable shall be Rs. 1000 only .

ITR filing deadline extended to November 15, 2024 :

Dated 27.10.2024 : CBDT has extended deadline for submission of IT Returns to November 15th , 2024 from the existing 31st, October 2024 to the corporations and other individuals who have to submit the audit reports .

The circular reads ” The Central Board of Direct Taxes (CBDT), in exercise of its powers under section 119 of the Income-tax. Act,1961 (‘the Act’), extends the due date of furnishing of Return of Income under sub-section ( 1) of section 139 of the Act for the Assessment Year 2024-25 in the case of assessees referred to in clause (a) of Explanation 2 to sub-section ( 1) of section 13 9 of the Act, which is 3 1’1 “

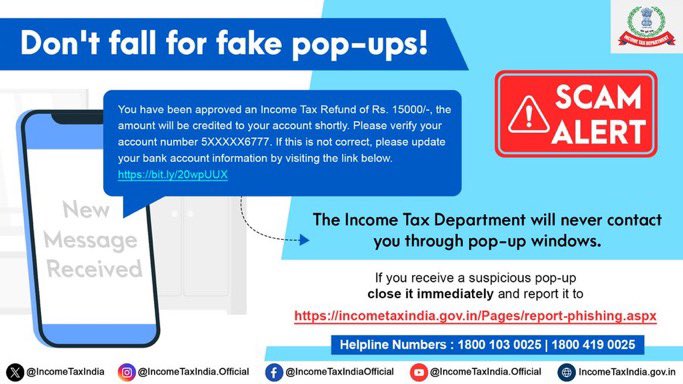

BEWARE OF FAKE INCOME TAX REFUND MESSAGES :

Dated 19.08.2024 : After submitting their Income tax returns , tax payers will be waiting for tax refund from the income tax department . Utilizing the anxiety on the part of tax payers , scamsters are preying on such people by sending fake IT refund messages to them . The messages typically inform of approval tax refund and ask the receivers to confirm the bank account number by clicking on the link provided by them .

Once you click on the fake website , your bank accounts will be hacked and emptied . Hence be beware and go to the official e-filing website of the income tax department for knowing the present status of your income tax return processing and you will be informed about any refund you are receiving .

To check status of your IT Return .

1. Log in to e-filing website with your PAN Number and Pasword

2. Click on view ITR status 3. You can see what is the position of your return whether it is processed or yet to be processed

4. If processed , Refund / demand position To check status of your IT Refund .

1. Log in to e-filing website with your PAN Number and Pasword 2. Click on services > Know your Refund status

3. Click on the selected Assessment year 2024-25 , you will know the refund status 4. If refund is shown , login to your bank account and see the refund is credited to your account or not.

Do you know ? There are 12 Tax rebates you can claim while submitting IT Returns , when when you have not even made any fresh investments .

DO YOU KNOW ? : Senior citizens can claim Tax Rebate under section 80D even without having paid health insurance premium .

For details of such rebates , CLICK HERE

You may also go through our article : INCOME TAX REBATES THAT DON’T NEED FRESH INVESTMENTS

Submit IT Returns within Due Date

For step by step guide to file ITR1 , CLICK HERE For step by step guide to file ITR2 , CLICK HERE

Income tax return forms for FY 2023-24 ( AY 2024-25 )

YOU MAY DOWNLOAD THE FORM BY CLICKING ON THE FORM NUMBER BELOW

ITR 1- SAHAJ : For individuals being a resident (other than not ordinarily resident) having total income up to Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income up to Rs.5 ,000

NOTE : Not for an individual who is either Director in a company or has invested in unlisted equity shares or in cases where TDS has been deducted u/s 194N or if income-tax is deferred on ESOP

Key changes : 1. You have to indicate whether you wish to exercise the option u/s 115BAC(6) of Opting out of new tax regime? (default is “No”)

2. A new column has been added to claim deduction under section 80CCH

ITR2 – For Individuals and HUFs not having income from profits and gains of business or profession

ITR-3 – For individuals and HUFs having income from profits and gains of business or profession

ITR-4- SUGAM : For Individuals, HUFs and Firms (other than LLP) being a resident having total income up to Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE .

NOTE : Not for an individual who is either Director in a company or has invested in unlisted equity shares or if income-tax is deferred on ESOP or has agricultural income more than Rs.5000 .

ITR-5 – For persons other than- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7

ITR-6 -For Companies other than companies claiming exemption under section 11

WHO HAS TO FILE IT RETURNS ?

Every individual or Hindu Undivided Family ( HUF ) is obliged to submit Income Tax returns if they meet following criterion .

1. Income exceeding Rs 2,50,000 in case of individuals below 60 years 2. Income exceeding Rs 3,00,000 in case of individuals above 60 years and below 80 years 3. Income exceeding Rs 5,00,000 in case of individuals above 80 years

Note : Income means total income in the financial year 2023-24 before allowing deductions under chapter VI -A of Income tax act . Further you have to submit your IT Return if you have

1. expended more than Rs. 2 lakh on foreign travel or2. paid more than Rs. 1 lakh on electricity consumption in a year

3. deposited more than Rs. 1 crore in a current account in a year, even if your income is less than the threshold limit .

Note : 1. If TDS / TCS has been collected from your account , you have to file your IT Returns to claim refund , even when you are not taxable for the year . If TDS or TCS collected is more than Rs 25,000 ( Rs 50,000 for the senior citizens ) , submission of IT Returns is mandatory . 2. If your income exceeds basic exemption limit , you have to submit your IT Returns even though you are not liable for any income tax . For example your income is below Rs 7.00 lakhs and you are not liable to pay tax on the basis of section 87A3. You have filed your audit report , but not filed your IT Returns . You have to complete the process by filing the returns . 4. If you hold any asset outside India or beneficiary of any asset outside India or a signing authority for an account outside India , you have to submit IT Returns if you are a resident Indian .

When to file Income Tax returns for AY 2024-25 ?

Income tax returns Due Dates for AY 2024-25 :

Income tax Returns are to be filed on or before 31st , July 2024 by all assessee other than(a) corporate-assessee or

(b) non-corporate assessee (whose books of account are required to be audited) or(c) partner of a firm whose accounts are required to be audited or the spouse of such partner if the provisions of section 5A applies or (d) an assessee who is required to furnish a report under section 92E.

Due date for filing of return of income for the assessment year 2024-25 is 31st, October 2024

if the assessee (not having any international or specified domestic transaction) is(a) corporate-assessee or

(b) non-corporate assessee (whose books of account are required to be audited) or(c)partner of a firm whose accounts are required to be audited or the spouse of such partner if the provisions of section 5A apply

IMPORTANCE OF FILING RETURNS WITHIN DUE DATE :

The Due date for submission of above returns fixed for the Financial Year 2023-24 is now 31.07.2024 . However ,it is advisable to file as early as possible to avoid last moment scramble to get relevant papers / details for filing the same .

Delay in filing the return of income may attract certain adverse consequences. Following are the consequences of delay in filing the return of income:

1 . Loss (other than loss under the head “Income from house property”) cannot be carried forward.2. Levy of interest under section 234A.

3 . Levy of fee under section 234F*4. Exemptions/deductions under sections 10A, 10B, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID and 80-IE are not available.

W.e.f. assessment year 2018-19, if assessee failed to furnish return of income within due date as prescribed in section 139(1) then he is required to pay Rs. 5000 if return is furnished on or before 31 December of assessment year.

However, if total income of the person does not exceeds Rs. 5 lakh then fee payable shall be Rs. 1000.

TAX PLANNING FOR FY 2023-24 ( AY 2024-25 ) Comprehensive Article on Income tax changes in Rules, Rates , Slabs , Rebates and Estimation

CLICK HERE TO READ

DOCUMENTS REQUIRED TO FILE ITR FORMS FOR SALARIED PERSONS / PENSIONERS :

NECESSARY DOCUMENTS TO BE OBTAINED BEFORE FILING IT RETURNS

a. You require following documents before starting to fill up IT Returns or to verify pre-filled IT Returns . As some time is required to collect from the relevant issuers , you may contact them at the earliest if you have not obtained so far . If you don’t have AADHAR , APPLY NOW AND OBTAIN ENROLLMENT ID OF AADHAR APPLICATION

1. Your AADHAR NUMBER / CARD 2.Salary certificate / Form 16 issued by employer in the new format ,

3.Interest certificates issued by your banks for the deposits / education loans and housing loans etc 4. Life Insurance premium certificates , health Insurance premium paid certificates ,

5. Bank account statements for housing loans and savings bank accounts etc 6. TDS Certificates from employers / Deposit holders

7. Form 26 AS / New Annual Information Statement ( AIS ) which show the tax amount already credited to your account and details of your income reported so far . 8. Capital gain certificates / statements from your stock brokers

9. Copy of last year return submitted .10. Your bank name , account number and IFSC code of the bank branch .

11. Total dividend received by you , quarter wise. Your bank account statement or your stock broker will fetch you the information . 12 . Any other relevant documents if you have any other income

b. Link your Aadhar number to income tax e-filing website

C. Verify Taxes paid already in Form 26AS / AIS and confirm that all tax deducted for you by your employer / bank as given in Form 16 or Salary receipt is credited to your account with income tax department . You can view 26 AS ( Tax Credit ) in the income tax department’s website by logging in .

d. Tax returns are made simple now . You may prepare and submit on line itself on the income tax e-filing website You may yourself file on line or use or utilize the service of Tax Return Preparers ( TRPS ) authorized by Income Tax Department ., if you are not confident of using the on -line services . Otherwise you may use your chartered accounts for the job .

You should keep following details handy for yourself / your employer and your tenant

Your Details 1. Aadhar Number

2. Mobile Number 3. E-mail address

4. Residential Address5. Passport Number ( If you have passport )

Other Details :

A. Have you deposited more than Rs 1.00 crore in bank accounts ? B. Have you incurred more than Rs 2.00 lakhs for Foreign Travel ?

C. Have you spent more than Rs 1.00 lakh on electricity consumption (All the limits of outgo for the entire year ) For persons with salary income :

6. Details of your Employer

a. TAN Number of the Employer b. Name of the Employer

c. Nature of Employer d. Address of the Employer

7. Details of all bank accounts held any time during the year

a. IFSC Code of the bank b. Name of the bank

c. Account number

7. If you have let out a property a. Address of the property

b Details of the tenant 1. Name of the Tenant

2. Tenant’s Aadhaar Number 3. Tenant’s PAN Number

The benefits of filing tax returns early is

1. You will have sufficient time to collect relevant documents , prepare , cross check and then submit . You can reduce errors . 2. As the income tax servers would be relatively free , last minute slowdown of computers due to heavy rush for submissions .

3. Processing of your returns by IT department would be faster and you will get refunds faster . 4. You will be avoiding penalties , interest etc levied on belated submission .

So take steps now to have advantages of filing IT Returns early

MATCHING OF FORM 26AS / NEW AIS WITH YOUR IT RETURNS

It is important to match the information in Form 26AS / New AIS with the information you provide in the Income tax returns as any mismatch may attract lengthy / unwanted correspondence with the income Tax department later . Now Income Tax department will assist you with pre-filled forms in their new e-filing portal . This will be backed with the information they receive which will also reflect in Form 26as . Hence it becomes easier for you to match the information in your IT returns with that of Form 26as .

To know how to download Form 26AS in the new website , CLICK HERE

SELECT BETWEEN OLD TAX REGIME AND NEW REGIME

While filing IT Returns , there is a question : Are you opting for new tax regime u/s 115BAC ? Yes No

Before filling just check which is beneficial for you old tax regime with rebates or new simplified system with lower tax rates and without any rebates . Before answering , check which is beneficial for you by going to our webpage and finding the answer yourself

INCOME TAX DEPARTMENT WARNS SALARIED PERSONS AGAINST WRONG DECLARATIONS WHILE FILING OF IT RETURNS :

As per amended section 270A of Income Tax act , mis-reporting of income may be fined 50 % of tax payable and it can go up to 200% if it is judged as concealment of income .

For 270A section of IT Act , CLICK HERE and fill 270A in section column

THIS ARTICLE CARRIES INFORMATION ON VARIOUS TAX PROVISIONS WHICH ARE GENERALLY USEFUL .YET IT DOES NOT CARRY ALL THE PROVISIONS AND HENCE YOU ARE ADVISED TO GO THROUGH INCOME TAX DEPARTMENT WEBSITES FOR AUTHENTIC COMPLETE INFORMATION . ESPECIALLY THOSE WHO HAVE GOT MULTIPLE STREAMS OF INCOME OR COMPLEX INVESTMENTS MAY CONSULT A QUALIFIED TAX CONSULTANT / CHARTERED ACCOUNTANT FOR ANY CLARIFICATION. READERS ARE ALSO WELCOME TO SEND FEEDBACK . YOU CAN DOWNLOAD THE FORM HERE . WE ARE OPEN FOR CORRECTION IF NEEDED

We value your opinions , comments and suggestions. We shall be happy to your feedback on the contents of the Article .