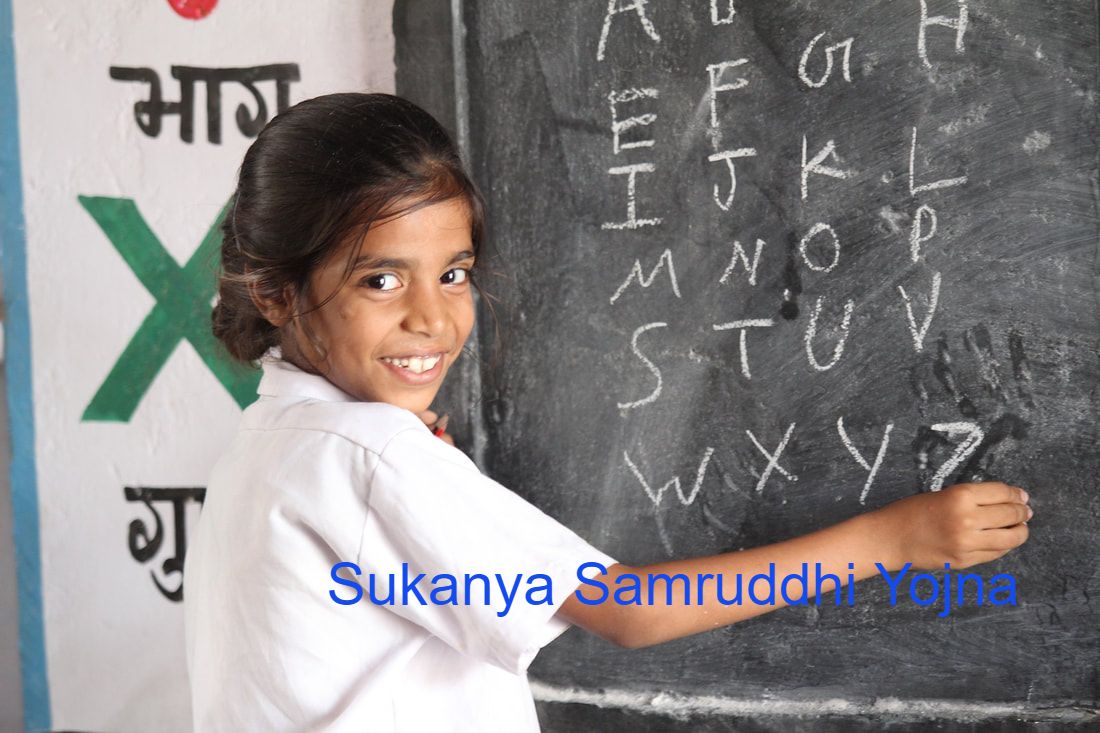

SUKANYA SAMRUDDHI ACCOUNT -Savings Scheme

for Girl child’s Education and marriage expenses

Sukanya Samruddhi Account :

Sukanya Samriddhi Account is a savings scheme initiated by the Government of India as part of its “Beti Bachao, Beti Padhao” campaign promoted by the Prime Minister Sri Narendra Modi . It aims to encourage parents to save money for the future education and marriage expenses of their girl child.Under the scheme, parents or legal guardians can open a savings account in the name of their girl child who is aged 10 years or younger. The account can be opened in any post office or authorized banks. The minimum deposit required to open the account is Rs. 250, and the maximum deposit limit is Rs. 1.5 lakh per year.

SALIENT FEATURES OF SUKANYA SAMRUDDHI ACCOUNT :

The Plan is administered by Post Offices across India and select commercial banks

SALIENT FEATURES :

• Minimum INR. 1000/-and Maximum INR. 1,50,000/- in a financial year. Subsequent deposit in multiple of INR 100/- Deposits can be made in lump-sum No limit on number of deposits either in a month or in a Financial year

• A legal Guardian/Natural Guardian can open account in the name of Girl Child.

• A guardian can open only one account in the name of one girl child and maximum two accounts in the name of two different Girl children.

• Account can be opened up to age of 10 years only from the date of birth. For initial operations of Scheme, one year grace has been given. With the grace, Girl child who is born between 2.12.2003 &1.12.2004 can open account up to1.12.2015.

• If minimum Rs 1000/- is not deposited in a financial year, account will become discontinued and can be revived with a penalty of Rs 50/- per year with minimum amount required for deposit for that year.

• Partial withdrawal, maximum up to 50% of balance standing at the end of the preceding financial year can be taken after Account holder’s attaining age of 18 years.• Account can be closed after completion of 21 years.

• If account is not closed after maturity, balance will continue to earn interest as specified for the scheme from time to time.

• Normal Premature closer will be allowed after completion of 18 years /provided that girl is married.

Account can be opened in Post office or specified commercial Banks ( For list of commercial banks and to visit their websites CLICK HERE

Tax Benefits:

Deposits made to the SSY account qualify for deduction under Section 80C of the Income Tax Act.

Interest earned on the account is exempt from income tax under Section 10 of the Income Tax Act

Interest Rate for Sukanya Samruddhi Account :

The account earns a higher rate of interest than regular savings accounts, and the interest rate is revised by the government on a quarterly basis . For the present quarters of July 2023 to September 2023 and October 2023 to December 2023 , Government had fixed the interest rate at 8 % pa . Now it is hiked to 8.2 % pa from the 1st , January 2024 .

How to apply for Sukanya Samruddhi Account ?

A Sukanya Samriddhi account can be opened at any participating bank or Post Office branch.To open the account, complete the steps outlined below:

Go to the bank or Post Office where you want to open the account.

Fill out the application form with the necessary information and attach any supporting papers.

Pay the first deposit in cash, check, or demand draught. The payment can range between Rs.250 and Rs.1.5 lakh.

Your application and payment will be processed by the bank or the Post Office.

After processing, your SSY account will be activated. A passbook will be supplied for this account to commemorate the account’s opening

Documents required to open a Sukanya Samruddhi Account :

Birth certificate of the girl child

Photo ID of applicant parent or legal guardian

Address proof of applicant parent or legal guardian

Other KYC proofs such as PAN, and Voter ID.

SSY account opening form.

A medical certificate has to be submitted in case multiple children are born under one order of birth.

Any other documents that are requested by the bank or post office.

Banks Authorized to Open Sukanya Samriddhi Yojana (SSY) Accounts

Here are some of the major banks in India that are authorized to open Sukanya Samriddhi Yojana accounts:

Public Sector Banks:

State Bank of India (SBI)

Bank of Baroda

Canara Bank

Punjab National Bank

Union Bank of India

Bank of India

Indian Bank

UCO Bank

Central Bank of India

Bank of Maharashtra

Punjab & Sind Bank

Indian Overseas Bank

Private Sector Banks:

ICICI Bank

HDFC Bank

Axis Bank

Kotak Mahindra Bank

Yes Bank

IndusInd Bank

Note: While this list includes many major banks, it’s always recommended to double-check with your preferred bank or visit the official website of the Sukanya Samriddhi Yojana to get the most accurate and up-to-date information.

DISCLAIMER

Use of the information at this site www.plannprogress.com is at one’s own risk. We do not offer to sell or solicit to buy any financial instruments including Deposits , Loans whether short term or otherwise , Mortgages , Stocks , Insurance or Mutual Funds .This site does not offer to sell or solicitation to buy any securities and we will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein are purely for educational purposes and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice.

Entry to this site is free of charge and we do not charge any fees what so ever . No need for registration for viewing the site . All content and information is provided on an ‘As Is’ basis by us. Information herein is believed to be reliable, but does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. As a condition to accessing http://www.plannprogress.com content and website, you agree to our Terms and Conditions of Use, Privacy policy & Disclaimer available on the links . The performance data quoted represents past performance and does not guarantee future results.

Articles/ Pages in this site contain advertisements and links to various third party sites / blogs as we have found articles therein interesting and useful and we believe reliable . Those links sites and advertisements may contain offer of sales or services of various kinds including financial services . We accept no responsibility for the accuracy , correctness and/or completeness of any information contained therein as we have not independently verified. The links and third party advertisements are governed by the privacy policy of those third party sites / blogs. We do not warrant or guarantee for any services or sales utilized therein . This site expressly disclaims all warranties and conditions of any kind, whether express or implied. However readers are advised to exercise their discretion in utilising / following any advice contained therein or utilizing any services or accepting their sales or any other offers and we do not take any responsibility what so ever.

The site is governed by Indian Laws and comes within the jurisdiction of courts in Mysuru , Karnataka , India

Contact Information : The site www.plannprogress.com is owned and operated by Mr . Manjunathan B.N. , No 37, 5thBlock , Madhuvana Layout , Sriramapura 2nd stage , Mysuru 570023 , Karnataka , India and can be contacted at email : info@plannprogress.com

Copyright © PlannProgress – All Rights are Reserved | Powered by PixelFlare

This website uses cookies to provide necessary site functionality and to improve your experience. By using this website, you agree to our use of cookies.