Indian Investor’s Guide:

Dated 22.02.2026 : The world of Indo-US trade was turned upside down on Friday, February 20, 2026. While American headlines focused on the legality of the $2,000 “Tariff Bonus,” Indian investors were watching something much more significant: the collapse of the “Reciprocal Tariff” regime and the immediate birth of “Plan B.”

For the Indian investor, this isn’t just a legal drama in Washington—it is a massive shift in the earnings potential of India’s biggest export-oriented stocks.

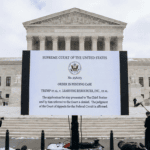

The Ruling: In a landmark 6-3 decision, the U.S. Supreme Court ruled that the sweeping reciprocal tariffs imposed under emergency powers were illegal.

The Immediate Impact for India: Earlier this month, India had negotiated an interim trade deal that brought our tariff rate down to 18%. However, following the court’s ruling, President Trump has pivoted to a 10% global surcharge under Section 122 and further increased to 15 % subsequently

For the next 150 days, Indian goods are entering the U.S. at a significantly lower rate than the “punitive” 50% seen last year, and even lower than the 18% we just signed for. This “accidental discount” creates a unique window of opportunity for specific sectors.

💊 1. The Pharma Powerhouse: Generic Relief

The U.S. pharmaceutical market is the “bread and butter” for Indian drugmakers. With the threat of 50% tariffs now legally neutralized, the margin expansion for these stocks is real.

- Sun Pharmaceutical Industries (SUNPHARMA): As India’s largest drugmaker, Sun Pharma generates roughly 35% of its revenue from the US. The reduction in tariff uncertainty allows their specialty portfolio (like Ilumya and Winlevi) to breathe. With consolidated margins already at a healthy 31%, any tariff relief drops straight to the bottom line.

- Dr. Reddy’s Laboratories (DRREDDY): Dr. Reddy’s has one of the highest US exposures in the Nifty Pharma index (40-45% of sales). Analysts estimate that the shift from the high-tariff regime of 2025 to the current 10% surcharge could boost their annual profitability by nearly ₹800–1,200 crore.

- Aurobindo Pharma (AUROPHARMA): Watch this stock closely. They are the “volume kings” of US generics. Lower tariffs mean higher competitiveness against Southeast Asian rivals who are also facing the 10% flat tax.

2. Textiles: The “Tirupur Recovery”

The textile sector was the hardest hit in 2025, with production in hubs like Tirupur and Coimbatore dropping by 30%. The SCOTUS ruling is the “Green Signal” this sector needed.

- KPR Mill (KPRMILL): KPR is a vertically integrated giant. With the U.S. being their single largest market, the move toward a lower, more stable 10% tariff makes their “Knitted Apparel” exports far more attractive to US retailers like Walmart and Target.

Gokaldas Exports (GOKEX): With nearly 80% of their revenue linked to the US, Gokaldas is a high-beta play on Indo-US trade relations. The stock has already begun re-rating as order visibility for the Winter 2026 season improves following the “Tariff-gate” ruling. - Welspun Living (WELSPUNLIV): In the home textiles space (towels and sheets), Welspun is a dominant player. The 15% flat tariff puts them at a price advantage over Chinese competitors who are facing additional “Section 301” scrutiny

3. IT Services: The Sentiment Shield

Technically, IT services don’t pay “import tariffs” on software. However, the indirect impact is massive.

- TCS & Infosys: When US-India trade tensions are high, US Fortune 500 companies hesitate to sign long-term “Managed Services” contracts. The SCOTUS ruling and the subsequent “friendly” comments from the White House regarding the “India Deal” have restored CEO confidence.

- The “H-1B” Factor: A stable trade relationship often leads to more predictable visa policies. Investors should look for a “relief rally” in the Nifty IT index as the geopolitical risk premium fades.

💎 4. Gems & Jewelry: Surat’s Second Chance

The interim trade deal included a “Zero Duty” provision for Indian diamonds and platinum.

- Titan Company (TITAN): While Titan is domestic-heavy, its export arm and international “Tanishq” expansion benefit from cheaper movement of raw materials.

- The Surat Impact: Smaller, listed players in the diamond processing space will see a massive easing of working capital pressure as they no longer have to “park” extra cash for high tariff deposits at US ports.

⚠️ The Investor’s Risk Checklist

While the news is good, this is not a “blind buy” market. Investors must watch three things over the next 30 days:

- The 150-Day Clock: The current 10% tariff is temporary. By July 2026, the U.S. Administration must either get Congressional approval or find a new legal loophole.

- The Refund Dispute: The U.S. owes billions in refunds for the “illegal” tariffs. If the Trump administration refuses to pay, India could retaliate, restarting the trade war.

- The “Russian Oil” Clause: The US relief for India is conditional on India reducing purchases of Russian energy. Any shift here could bring the tariffs back instantly

💡 Final Thoughts

For the Indian investor, the “Human-AI Certified” analysis of these trends suggests a “Buy on Dips” strategy for export-oriented stocks. We are entering a phase of “Stable Protectionism”—the tariffs exist, but the unpredictability has been removed by the Supreme Court.

Stock to Watch: If you want one stock that captures the entire trade recovery, watch KPR Mill. It combines labor-intensive manufacturing (which the Indian government wants to protect) with high US demand (which the US consumer needs).

Watch List Table

| Company | Sector | US Revenue Exposure | Key Outlook (Post-Feb 2026 Ruling) |

| Gokaldas Exports | Textiles | 50% – 70% | High Sensitivity: The biggest winner from the 18% tariff cap. Margins are expected to rebound as pricing power returns. |

| Welspun Living | Home Textiles | ~66% | Market Leader: Dominates US bath towel market. Lower tariffs secure its “big-box” retailer contracts for FY27. |

| Infosys | IT Services | 60.8% | Sentiment Play: Reduced trade friction supports discretionary tech spending. Focus on AI-led deal wins in North America. |

| TCS | IT Services | ~50% | Stable Giant: Strong TCV (Total Contract Value) in the US. Seen as a “safe haven” amid global trade realignments. |

| Aurobindo Pharma | Pharmaceuticals | 43.2% | Volume Driven: High dependence on US formulations. The 18% cap prevents a margin collapse in generic pricing. |

| Dr. Reddy’s | Pharmaceuticals | 34% – 37% | Differentiated: US generics presence is strong. Recent “Buy” ratings reflect optimism on its US product pipeline. |

| Sun Pharma | Pharmaceuticals | ~31% | Specialty Focus: Less hit by flat tariffs due to high-margin specialty drugs ($1.1B+ in US sales). |

| Cipla | Pharmaceuticals | ~28% | Recovery Track: US sales recently beat expectations. Planning 4 major respiratory launches in the US by end of 2026. |

| KPR Mill | Textiles | Significant | Cost Advantage: Integrated model + 18% tariff cap makes them highly competitive against Vietnam and China. |

| Titan Company | Gems & Jewelry | Strategic Link | Margin Relief: US is the top market for cut diamonds. Lower duties reduce “landed cost” for the upcoming US festive season. |

.

DISCLAIMER: This article provides general information and it’s not financial advice. We have not independently verified the veracity of claims, advice made by the various platforms quoted in the article, and we have no commercial interest in them. We are not SEBI-registered investment advisors, and this content does not constitute investment advice. Consult your SEBI-approved financial advisor before making any investment decision.

“Note on AI Usage: This post was written with the assistance of AI tools for research, drafting, and image generation. All content has been human-reviewed and edited for accuracy and tone to ensure it meets our quality standards.”