AADHAAR NEWS

YOU CAN TEST REVAMPED AADHAAR MOBILE APP

New Aadhaar app enables QR-based offline ID checks

Verification may become routine in daily public spaces

Dated 27.11.2025 : The Unique Identification Authority of India (UIDAI) has been actively working on and testing new features and services, primarily focused on a revamped Aadhaar mobile application and the concept of offline verification.

New Aadhaar Mobile App Features

- Digital Wallet and Offline Access: The new app is designed as a profile-centric digital wallet to store and present your Aadhaar details on a smartphone, even offline, after initial setup.

- Multi-Profile Management: The ability to add and manage up to five Aadhaar profiles on a single device, useful for families, as long as the Aadhaar numbers share the same registered mobile number.

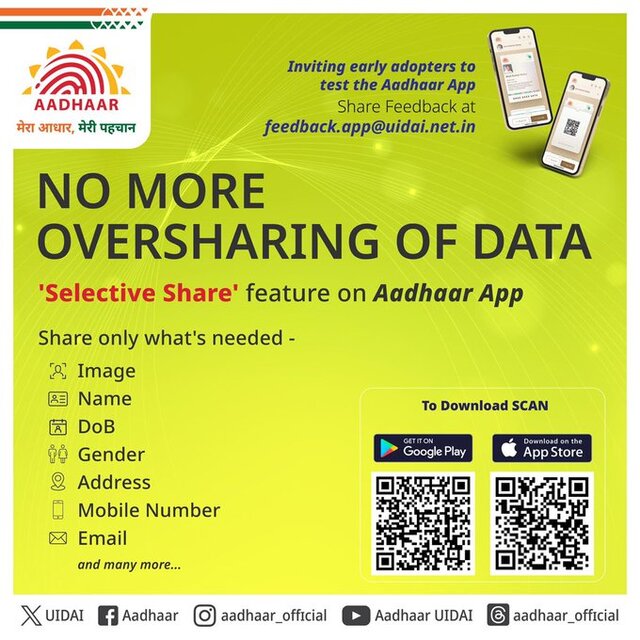

- Selective Data Sharing: This innovative feature enables users to select precisely which fields (such as name and photo, but not address or full phone number) they want to share for verification, thereby enhancing their privacy.

- Enhanced Security & Authentication:

- Face Authentication: Required for profile activation after OTP verification to confirm physical presence.

- Biometric Lock/Unlock: Users can enable a biometric lock (fingerprint/face) to restrict access to the stored Aadhaar profile data.

- QR Code-Based Verification: The app supports generating and verifying QR codes for quick, paperless, and contactless checks.

Focus on Offline Verification

A major development is the push for offline Aadhaar verification, which is designed to:

- Eliminate Photocopies: Discourage the practice of sharing physical photocopies of the Aadhaar card.

- Routine Identity Checks: The system, using the new app and QR codes, is being prepared for everyday scenarios like:

- Hotel check-ins

- Entry into residential societies or offices

- Student New Aadhaar App: Status

- The new Aadhaar App has been launched in an “early access” phase for the general public on both the Google Play Store (Android) and the Apple App Store (iOS).

- Available for Download: You can download the app right now from the official app stores.

- Purpose: This early access phase allows residents to explore the new features, test its performance, and share feedback before the final version is officially rolled out.verification during exams

UIDAI is also working on fresh regulations for businesses to become Offline Verification Seeking Entities (OVSEs) to govern this system.

Can you test the features ?

The Unique Identification Authority of India (UIDAI) has made its new mobile application, often referred to simply as the “Aadhaar App”, available for the public.

The UIDAI has encouraged residents to download and use the app to experience the next-generation features, which include:

- Offline Verification: Using the digital Aadhaar on your phone, even without an internet connection.

- Selective Data Sharing: The ability to choose whether to share your complete or only selective Aadhaar information (e.g., just name and photo, not address) for verification.

- Multi-Profile Management: The convenience of managing up to five family members’ Aadhaar profiles on a single device (provided they are linked to the same registered mobile number).

- Enhanced Security: Features like mandatory face authentication for setup and a one-click biometric lock/unlock.

By using the app in this phase, you are helping the UIDAI refine the product before its final, wider launch.

The new Aadhaar app is designed to bring significant benefits to both the general public (Aadhaar holders) and the verifying agencies (governments, banks, hotels, telecom companies, etc.).

The app’s new features are primarily focused on enhancing privacy, control, and convenience for the resident.

Feature | Primary Benefit for the Public |

Selective Data Sharing | Enhanced Privacy: You can choose to share only the required details (e.g., just name and photo) and mask sensitive information like your full address or date of birth, reducing the risk of data misuse. |

Biometric Lock/Unlock | Increased Security: Gives you complete control over your biometric data. Once locked, your biometrics cannot be used for any verification until you intentionally unlock them via the app. |

Offline Verification | Convenience: You can prove your identity using a QR code even in areas with poor or no internet connectivity, after the initial profile setup. |

Multi-Profile Management | Ease of Use for Families: You can add and manage up to five family members’ Aadhaar profiles on a single phone (if they share the same registered mobile number), simplifying identity checks for the whole household. |

Elimination of Photocopies | Security & Convenience: No need to carry a physical card or hand over photocopies, which are prone to loss or misuse. |

For Verifying Agencies (OVSEs)

Agencies that need to verify identity (like banks, hotels, or government departments—called Offline Verification Seeking Entities or OVSEs) benefit from reduced fraud, faster processes, and better compliance.

Feature | Primary Benefit for Verifying Agencies |

QR Code-Based Verification | Reduced Fraud: Scanning the QR code provides instant, authentic, and tamper-proof verification of the digital Aadhaar data, unlike physical photocopies which can be easily faked. |

Faster, Paperless KYC | Operational Efficiency: The verification process becomes as quick as a QR code scan (similar to UPI payments), drastically speeding up processes like hotel check-ins, event entry, or bank account opening. |

Offline Capability | Reliability: Verification can proceed smoothly even without a live internet connection, making the system viable in remote areas. |

Confirmation of Presence | Higher Security: Features like mandatory Face Authentication during the app setup can ensure that the person presenting the digital Aadhaar is the genuine holder. |

The new app gives control to the public while providing authenticity and efficiency to the verifying agencies.

AADHAAR AND THE VOTER ID

Dated 23.08.2025 : The Supreme Court of India issued the latest instructions on using Aadhaar for voter cards on Friday, August 22, 2025 . This directive came during a hearing of petitions challenging the Special Intensive Revision of electoral rolls in Bihar. The court’s order clarified that while the Election Commission of India (ECI) has a list of 11 acceptable documents, an Aadhaar card can be used as a valid document for applicants seeking inclusion in the electoral list

The key points of the Supreme Court’s directives are:

- Aadhaar is a valid document: The Supreme Court has permitted the use of Aadhaar as a valid identity document for applicants seeking inclusion in the electoral list. It has directed the Election Commission of India (ECI) to accept Aadhaar cards, along with 11 other documents, as proof of identity for those applying for re-inclusion in the voter list.

- Aadhaar is not conclusive proof of citizenship: While allowing Aadhaar to be used as an identity document, the Supreme Court has reiterated that it is not conclusive proof of Indian citizenship. The court has affirmed that the authority to determine citizenship rests with other bodies, not the ECI.

- Online submissions allowed with Aadhaar: The court has permitted online submission of claims for deleted voters using an Aadhaar card or any of the other acceptable documents.

- Context of the ruling: These directives came in response to a batch of petitions challenging the ECI’s Special Intensive Revision (SIR) of electoral rolls in Bihar, where a large number of voters were excluded from the draft list. The court’s intervention aims to make the revision process more “voter-friendly” and transparent.

Can Aadhaar be the sole identity for issuing voter ID?

Aadhaar cannot be the sole document to prove your eligibility for a voter ID.

Here’s why:

- Aadhaar is not proof of citizenship: Both the Supreme Court and the Election Commission of India (ECI) have consistently stated that an Aadhaar card is a proof of identity, not a proof of citizenship. Since voting is a right reserved for citizens, a voter ID requires proof of citizenship. Other documents, like a birth certificate or a passport, are considered stronger evidence of citizenship.

- Multiple documents are required: To apply for a new voter ID, you typically need to submit documents for three different purposes:

- Proof of Identity (e.g., Aadhaar, PAN card, driving license, passport).

- Proof of Address (e.g., electricity bill, ration card, rent agreement).

- Proof of Age (e.g., birth certificate, 10th or 12th class marksheet, passport). While Aadhaar can be used for both identity and sometimes address proof, it is not sufficient on its own to fulfill all the eligibility criteria.

It is essential to note that the court has emphasized that while linking Aadhaar is permitted, it is not a mandatory or sole requirement. The process is being monitored by the Supreme Court, with the next hearing scheduled for September 8, 2025

GET WALLET FRIENDLY PVC AADHAAR CARD :

Dated 25.10.2023 : UIDAI is issuing the Aadhaar card printed on PVC card with latest features for a payment of nominal charges of Rs 50 only . ( The charges are not changed since its first issue in 2020 ) . Residents who do not have registered mobile number can also order using Non-Registered /Alternate Mobile Number. .

This card contains security features like Secure QR Code , Hologram , Micro text , Ghost image , Issue Date & Print Date , Guilloche PatternEmbossed Aadhaar Logo . It comes in the size of a Debit card and can be easily carried in your wallet like credit cards .

HOW TO ORDER PVC AADHAAR CARD ?

1 . Go to UIDAI website by CLICKING HERE

2. Enter your 12 Digit Adhaar number 3. Enter Security code and ask for OTP

4. You will receive OTP on your registered mobile number 5. Once you enter otp , screen will be changed to pre-view Aadhaar card .

6 . If you find information is correct , then make payment of Rs 50 including GST by way of credit / debit cards or Net Banking or UPI . 7. On successful payment, you may receive the card in 5 days through Speedpost ( as per UIDAI )

Book an Appointment with Aadhaar service centre

.Dated 21.06.2024 : Before visiting an Aadhaar service centre , now you can book appoint in your desired service centre . This facility (pilot) is for booking an appointment at an Aadhaar Seva Kendra for Aadhaar services listed below:

● Fresh Aadhaar enrolment ● Name Update

● Address Update ● Mobile No. Update

● Email ID Update ● Date of Birth Update

● Gender Update ● Biometric (Photo + Fingerprints + Iris) Update

For further details , visit Aadhaar portal

CHARGES FOR VARIOUS AADHAR SERVICES : ( as of 22.06.2024 )

1. Aadhaar Enrolment or New Aadhaar : Free

2. Mandatory Biometric Update check for age group

05 to <07 years => FREE

07 to <15 years => Chargeable (Rs 100)

15 to <17 years => FREE

> 17 years => Chargeable (Rs 100)

3. Biometric Update with or without Demographic Update : Rs 100

4 . Demographic Update : Rs 50

5 . e-Aadhaar download and color print on A4 Sheet : Rs 30

6. Charges for Document Update Services : Rs 50

7. Charges for Home Enrolment Services : Rs 700

AADHAAR IS NO MORE A PROOF FOR DATE OF BIRTH :

Dated 19.01.2024 : Aadhaar is a document that establishes a proof of identity with biometric details and is not having any proof for the date of birth . Hence UIDAI has issued a circular confirming deletion of aadhaar from the list of documents which are used to confirm date of birth ( DOB ) of the individuals .

Ref : UIDAI CIRCULAR DATED 16.01.2024

DO NOT SHARE AADHAAR DETAILS IN SOCIAL MEDIA : UIDAI

Dated 31.12.2022 : UIDAI has advised public to exercise caution while sharing their Aadhaar details . The Resident Indians can use their Aadhaar number to verify and validate their identity . But while sharing Aadhaar with any trusted entity, the same level of caution may be exercised which one does at the time of sharing Mobile number, Bank account number or any other identity document like Passport, Voter Id, PAN, Ration Card etc .

If one does not wish to share his or her Aadhaar number, UIDAI provides facility for generating Virtual Identifier (VID). One can easily generate VID by visiting the official website or via myaadhaar portal, and use it for authentication in place of the Aadhaar number. This VID can be changed after the end of the calendar day .

One can also utilize the facility of Aadhaar locking as well as biometric locking. If a resident is not likely to use Aadhaar for a period of time, he or she may lock Aadhaar or biometrics for such a time period. The same can be unlocked conveniently and instantly, as and when required.

UIDAI also urges residents not to leave Aadhaar letter / PVC Card, or its copy thereof, unattended. Public are also advised not to share Aadhaar openly in public domain particularly on social media and other public platforms. Aadhaar holders should not disclose Aadhaar OTP to any unauthorized entity and refrain from sharing m-Aahaar PIN with anyone .

To read the UIDAI Press Release on the subject , CLICK HERE

UIDAI WITHDRAWS ADVISORY ON PHOTOCOPES OF AADHAAR & MASKED AADHAAR

Dated 30.05.2022 : Bengaluru Regional office of UIDAI had issued an advisory to general public on 27.05.2022 . In the advisory , UIDAI had asked public not to share photocopies of the Aadhaar with any organization as it is fraught with security risk . Instead they had asked the public to use Masked Aadhaar . Now UIDAI has issued a fresh notification withdrawing their Bengaluru Regional office press release and asked the public to use normal precaution . UIDAI has assured that Aadhaar Identity Authentication ecosystem has provided adequate features for protecting and safeguarding the identity and privacy of the Aadhaar holder . However one can use due diligence while sharing aadhaar details and use masked aadhaar wherever accepted What is Masked Aadhaar and how to download it ?

Mask Aadhaar option allows you to mask your Aadhaar number in your downloaded e-Aadhaar. Masked Aadhaar number implies replacing of first 8 digits of Aadhaar number with some characters like “xxxx-xxxx” while only last 4 digits of the Aadhaar Number are visible. 1. Go to Download Aadhaar page of UIDAI WEBSITE

2. Enter Aadhaar number and captcha .

3. Click on ” Do you want a Masked Aadhaar ”

4. Enter the OTP received o Registered mobile number

5. Masked aadhaar will be downloaded . It’s password protected .

Where to use Masked Aadhaar ?

You may use the Masked Aadhaar as identity proof when travelling in trains, at airports and for hotel bookings. It can also be used to prove your identity wherever required. However, it cannot be used for availing benefits provided under government welfare schemes through DBT.

AADHAAR UPDATE STATUS BY PHONE

Dated 25.11.2020 : If you have requested for Aadhaar update like change of address , correction in name , gender , language or date of birth , you may now get the latest status of your update request by phone . Hitherto one has to check it on-line only .

You may dial 1947 , furnish URN Number of Aadhaar and obtain the present position of the request earlier made . When you had submitted update request , you would have got a 14 digit number called URN or Update Request Number. This URN would have also received via SMS to your mobile number .

CHANGE OF ADDRESS MADE EASY

Dated 14.11.2019 : As per Gazette notification dated 13.11.2019 , new current address , other than recorded in the Aadhaar card may be provided to authorities by way of self declaration .

People who migrate to new places on taking up jobs were finding it difficult to avail services like banking as their address in Aadhaar card would be of their permanent residence in their native place and the current address will not match that in Aadhaar card . The rule change will help such persons in availing various services like banking , electricity or any other facility in the new place . With this change , banks and other authorities can record current address and communication will be easier .

The changes in rules have been made by amending the Prevention of Money-laundering (Maintenance of Records) Rules, 2005 .

MISQUOTING OF AADHAAR MAY ATTRACT PENALTY OF RS 10,000 :

Dated 13.11.2019 : While delivering budget speech on 05.07.2019 , Finance minister Ms Nirmala Sitharaman had announced making of PAN and Aadhaar interchangeable and allowing those who do not have PAN to file Income Tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN . It was also announced that the Income Tax Department would allot PAN to such person on the basis of Aadhaar after obtaining demographic data from the Unique Identification Authority of India (UIDAI). It was also proposed to provide that a person who has already linked his Aadhaar with his PAN may at his option use Aadhaar in place of PAN under the Act. Now the relevant sections of Income tax Act have been amended and have been amended and penalty of Rs 10,000 levied on misquoting of PAN number has been extended to misquoting of Aadhaar number

Now as per amended section 139A of the Income Tax act ,

” (a )A person who has not been allotted a permanent account number but possesses the Aadhaar number, may furnish or intimate or quote his Aadhaar number in lieu of the permanent account number, and such person shall be allotted a permanent account number in such manner as may be prescribed;

(b) A person who has been allotted a permanent account number, and who has intimated his Aadhaar number in accordance with provisions of sub-section (2) of section 139AA, may furnish or intimate or quote his Aadhaar number in lieu of the permanent account number.]

Thus PAN number and Aadhaar number have been made interchangeable for the purpose of the provisions of the Income tax act . Hence Aaadhaar number may be used for all transactions that needed quoting of PAN number . This liberalization extends now to the penalty being imposed on misquoting of PAN to Aadhaar also .

Now as per amended section 272B of the Income Tax act , penalty extends to misquoting of aadhaar as under :

” 1. If a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees.

(2) If a person who is required to quote his permanent account number 81[or Aadhaar number, as the case may be,] in any document referred to in clause (c) of sub-section (5) of section 139A, or to intimate such number as required by sub-section (5A) or sub-section (5C) of that section, quotes or intimates a number which is false, and which he either knows or believes to be false or does not believe to be true, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees 81[for each such default].

Further penalty of Rs 10,000 is levied on each transaction where Aadhaar number is misquoted . Hence if you quote wrong number , say in two transactions like remitting cash above Rs 10,000 or opening of SB account , you may be levied a penalty of Rs 20,000 . Hence one should be careful while quoting Aadhaar Number while using in lieu of PAN Number

For section 272B and 139A of income tax act , CLICK HERE and type relevant number to view them

RAJYASABHA PASSES BILL MAKING AADHAAR VOLUNTARY :

Dated 10.07.2019 : Rajyasabha on 8th, July 2019 passed Aadhaar and other Laws ( Amendments ) Bill making Aadhaar voluntary identification tool for opening bank accounts and obtaining mobile telephone services . The amendment bill was passed by Loksabha on 24th, June 2019 and it replaces an ordinance passed by the Government in March 2019 .

A clause introduced in Aadhaar Act under Section 8A makes it compulsory to obtain a user’s consent for off-line verification of identity and information so collected cannot be used for any other purpose . Further any violation of Aadhaar Act by any agency will attract penalty up to Rs 1 crore and jail term .

The bill seeks parent’s permission while enrolling a child in to Aadhaar ecosystem.

PAN AND AADHAAR MADE INTERCHANGEABLE

Dated 08.07.2019 : While delivering budget speech on 05.07.2019 , Finance minister Ms Nirmala Sitharaman announced making of PAN and Aadhaar interchangeable and allowing those who do not have PAN to file Income Tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN . She also made following announcements :

1. Interchangeability of PAN and Aadhaar: It is proposed to provide interchangeability of PAN and Aadhaar to enable a person who does not have PAN but has Aadhaar to use Aadhaar in place of PAN under the Act. The Income Tax Department shall allot PAN to such person on the basis of Aadhaar after obtaining demographic data from the Unique Identification Authority of India (UIDAI). It is also proposed to provide that a person who has already linked his Aadhaar with his PAN may at his option use Aadhaar in place of PAN under the Act.

2. Presently, the Act provides for making PAN invalid if it is not linked with Aadhaar within a notified date. In order to protect past transactions carried out through such PAN, it is proposed to provide that if a person fails to intimate the Aadhaar number, the PAN allotted to such person shall be made inoperative in the prescribed manner after the date notified for the said linking.

3. Government to consider issuing Aadhaar Card for Non-Resident Indians with Indian Passports after their arrival in India without waiting for 180 days.

LINKING AADHAAR MANDATORY TO FILE IT RETURN FOR FY 2018-19 : SUPREME COURT

Dated 08.02.2019 : A two member bench of the Supreme Court reiterated the mandatory linking of Adhaar to PAN card for filing of IT Returns .

As per the latest verdict passed by the bench consisting of judges Mr A K Sikri and Mr Abdul Nazeer in a case filed by the government of India against a judgement of Delhi High court , the bench observed that linkage of PAN with Aadhaar is mandatory fot filing IT Returns for the financial year 2018-19 ( Assessment year 2019-20 ) .

The Supreme Court has already upheld the constitutional validity of Aadhaar in its September 2018 judgement wherein it had upheld the mandatory linking of Aadhaar with PAN ( Permanent Account Number ) provided by Income Tax Department .

It is necessary to produce Aadhaar number while applying for a PAN card now . Ministry of Finance has already extended in July 2018 the time limit for linking Aadhar number to PAN number to 31.03.2019 .

Ina separate news , it is reported that just 230 million PAN cards out of 420 million PAN cards issued have been linked to Aadhaar now . Remaining PAN cards are yet to be linked . Hence all the persons who may have to submit IT Returns for fy 2018-19 may now take steps for linking their Aadhaar to PAN account if already not done .

Source : Various Media reports

HOW TO LINK AADHAAR TO PAN NUMBER , CLICK HERE

LOKSABHA PASSES BILL MAKING AADHAAR VOLUNTARY :

Dated 06.01.2019 : Loksabha on 4th, Jan 2019 passed Aadhaar and other Laws ( Amendments ) Bill making Aadhaar voluntary identification tool for opening bank accounts and obtaining mobile telephone services . The amendment bill complies with Supreme court order passed in September 2018 ( See news dated 26.09.2018 below ) .

The amendment to Telegraph Act passed on Friday makes Aadhaar based identification voluntary for mobile phone services and prohibits storage of adhaar biometric data or number by the mobile service providers in their storage system . Amendment to Prevention to Money Laundering Act makes Aadhaar voluntary for banking services . Further amendments make it clear that the services cannot be denied to a citizen for not providing aadhaar identification .

Further a new clause introduced in Aadhaar Act under Section 8A makes it compulsory to obtain a user’s consent for off-line verification of identity and information so collected cannot be used for any other purpose . Further any violation of Aadhaar Act by any agency will attract a term up to 10 years of jail .

Source : Various Media Reports

SUPREME COURT UPHOLDS CONSTITUTIONAL VALIDITY OF AADHAAR

Dated 26.09.2018 : Supreme Court today upheld the constitutional validity Of Aadhaar Act passed as money bill . However Justice Mr Chandrachud expressed his reservation about passing the bill as money bill to bypass Rajyasabha . But section 57 of Aadhaar Act , which allows private enteties to verify aadhaar , has been struck down by the Supreme Court . Similarly section 33 ( 2 ) that allows UIDAI to share data with authorised officers in the interest of national security is deleted .

It also upheld mandatory linking of Aadhaar with PAN ( Permanent Account Number ) provided by Income Tax Department . One is not required to produce Aadhaar for appearing in NEET , UGC and CBSE examinations. However Supreme court says it is not mandatory for opening Bank accounts , having mobile phones or school admissions. Further it made clear that private entities cannot demand aadhaar .

It also made clear that children cannot be denied any benefit including school admission for want of Adhaar .

Supreme Court asked the government to bring a robust law for protection of data as soon as possible . It also asked the centre to provide more security measures and less time of storage for data collected under Aadhaar .

The five bench division of Supreme Court is giving its decision on 27 petitions submitted to them challenging various aspect of Aadhaar , bio-metric identification system promoted by Government of India .

DISCLAIMER

Use of the information at this site www.plannprogress.com is at one’s own risk. We do not offer to sell or solicit to buy any financial instruments including Deposits , Loans whether short term or otherwise , Mortgages , Stocks , Insurance or Mutual Funds .This site does not offer to sell or solicitation to buy any securities and we will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein are purely for educational purposes and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice.

Entry to this site is free of charge and we do not charge any fees what so ever . No need for registration for viewing the site . All content and information is provided on an ‘As Is’ basis by us. Information herein is believed to be reliable, but does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. As a condition to accessing http://www.plannprogress.com content and website, you agree to our Terms and Conditions of Use, Privacy policy & Disclaimer available on the links . The performance data quoted represents past performance and does not guarantee future results.

Articles/ Pages in this site contain advertisements and links to various third party sites / blogs as we have found articles therein interesting and useful and we believe reliable . Those links sites and advertisements may contain offer of sales or services of various kinds including financial services . We accept no responsibility for the accuracy , correctness and/or completeness of any information contained therein as we have not independently verified. The links and third party advertisements are governed by the privacy policy of those third party sites / blogs. We do not warrant or guarantee for any services or sales utilized therein . This site expressly disclaims all warranties and conditions of any kind, whether express or implied. However readers are advised to exercise their discretion in utilising / following any advice contained therein or utilizing any services or accepting their sales or any other offers and we do not take any responsibility what so ever.

The site is governed by Indian Laws and comes within the jurisdiction of courts in Mysuru , Karnataka , India

Contact Information : The site www.plannprogress.com is owned and operated by Mr . Manjunathan B.N. , No 37, 5thBlock , Madhuvana Layout , Sriramapura 2nd stage , Mysuru 570023 , Karnataka , India and can be contacted at email : info@plannprogress.com

Copyright © PlannProgress – All Rights are Reserved | Powered by PixelFlare

This website uses cookies to provide necessary site functionality and to improve your experience. By using this website, you agree to our use of cookies.