BANK PENSIONERS LATEST NEWS

EXCLUSIVE NEWS FOR BANK PENSIONERS AND BANK RETIREES

Latest Pension Updation News for Bank Pensioners and Retirees

News for Bank Pensioners

BANK PENSIONERS DA WILL GO UP BY 62 SLABS FROM FEBRUARY 2026

Dated 31.01.2026: In tune with the rising Consumer Price Index , the Dearness Allowance ( DA ) payable to bank pensioners from February 2026 to July 2026 will be enhanced by 62 slabs .New DA Rates for the pensioners retired earlier is as follows

New DA Rates for the pensioners retired earlier are as follows :

- Pensioners retired after 31.10 2022 : 25.00 % of Basic Pay

- Pensioners retired after 31.10 2017 : 59.08 % of Basic Pay

- Pensioners retired between 01.11.2012 to 31.10 2017 : 132.20% of Basic pension

- Pensioners retired between 01.11.2007 to 31.10 2012 : 258.45 % of Basic pension

- Pensioners retired between 01.11.2002 to 31.10 2007 : 334.80 % of Basic pension

- Pensioners retired between 01.04 .1998 to 31.10 2002 :

- Up to Basic pension Rs 3,550 : 482.64 % + Rs 800

- Basic pension between Rs 3,551 to Rs 5,650 : 482.64 % + Rs 450

- Basic pension between Rs 5,651 : 482.64 %

The bankers retired before 01.4 .1998 , may go through AIBEA circular

WAGE & PENSION REVISION APPROVED For RBI , PSGIC & NABARBD by the Central Government

Dated 26.01.2026 : On January 23, 2026, the Central Government officially approved significant wage and pension revisions for the Reserve Bank of India (RBI), Public Sector General Insurance Companies (PSGICs), and NABARD.

This decision is expected to benefit over 46,000 serving employees and nearly 47,000 pensioners/family pensioners. Here are the specific details for each sector .

1. Reserve Bank of India (RBI)

The revision specifically focuses on enhancing the retirement benefits for those who have already served the institution.

- Effective Date: November 1, 2022.

- Pension Hike: An enhancement of 10% on the basic pension plus dearness relief.

- Total Impact: This results in an effective increase in basic pension by a factor of 1.43 (meaning a roughly 43% jump from previous levels).

- Beneficiaries: Approximately 30,769 retirees, including 8,189 family pensioners.

2. Public Sector General Insurance (PSGICs)

This covers companies like NICL, NIACL, OICL, UIICL, GIC, and AICIL.

- Wage Revision: Effective from August 1, 2022.

- Salary Hike: An overall wage bill increase of 12.41%, with a 14% hike on the existing Basic Pay and Dearness Allowance.

- Family Pension: Standardized to a uniform rate of 30% (up from previous lower tiered rates).

- NPS Contribution: The government’s contribution to the National Pension System (NPS) has been raised from 10% to 14% for employees who joined after April 1, 2010.

3. NABARD (The “Others”)

NABARD was the third major pillar included in this announcement.

- Salary Hike: A 20% increase in pay and allowances for all Group ‘A’, ‘B’, and ‘C’ employees.

- Effective Date: November 1, 2022.

- Pension Parity: Pensions for those who retired before November 2017 have been brought on par with former RBI employees who served in NABARD, addressing a long-standing demand for parity.

Summary of Financial Impact

The government has allocated a massive budget for these revisions, largely due to the retroactive “arrears” (back-pay) that will be paid out from 2022:

- Insurance Sector: ₹8,170.30 crore

- RBI Pensioners: ₹2,696.82 crore

- NABARD: Approximately ₹560 crore (including arrears)

Note: For employees in the general insurance sector, the revised family pension of 30% becomes effective from the date it is published in the official gazette, which is expected imminently following this announcement

To read the Press Release in this regard , CLICK HERE

BANK PENSIONERS DA FROM AUGUST 2025

Dated 01.08.2025: In tune with Consumer Price Index changes , the Dearness Allowance ( DA ) payable to bank pensioners from August 2025 to January 2026 will be as follows

- No change for pensioners retired up to to October 2022

- Reduction of 0.07 % DA for those retired after october 2022 .

New DA Rates for the pensioners retired earlier are as follows :

- Pensioners retired after 31.10 2022 : 21.13 % of Basic Pay

- Pensioners retired after 31.10 2017 : 54.74 % of Basic Pay

- Pensioners retired between 01.11.2012 to 31.10 2017 : 126.00% of Basic pension

- Pensioners retired between 01.11.2007 to 31.10 2012 : 249.15 % of Basic pension

- Pensioners retired between 01.11.2002 to 31.10 2007 : 323.64 % of Basic pension

- Pensioners retired between 01.04 .1998 to 31.10 2002 :

- Up to Basic pension Rs 3,550 : 467.76 % + Rs 800

- Basic pension between Rs 3,551 to Rs 5,650 : 467.76 % + Rs 450

- Basic pension between Rs 5,651 : 467.76 %

BANK PENSIONERS DA WILL GO UP BY 66 SLABS FROM FEBRUARY 2025

Dated 18.02.2025 : In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2025 to July 2025 will be enhanced by 66 slabs .New DA Rates for the pensioners retired earlier is as follows : Pensioners retired after 31.10 2022 : 21.20 % of Basic Pay

1. Pensioners retired after 31.10 2017 : 54.74 % of Basic Pay 2. Pensioners retired between 01.11.2012 to 31.10 2017 : 126.00% of Basic pension

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 249.15 % of Basic pension 2. Pensioners retired between 01.11.2002 to 31.10 2007 : 323.64 % of Basic pension

3. Pensioners retired between 01.04 .1998 to 31.10 2002 : a. Up to Basic pension Rs 3,550 : 467.76 % + Rs 800

b. Basic pension between Rs 3,551 to Rs 5,650 : 467.76 % + Rs 450c. Basic pension between Rs 5,651 : 467.76 %

Similarly the pensioners retired earlier will also get DA enhancement

GUIDELINES FOR FILING WRIT APPLICATIONS FOR RESTORATION OF COMMUTEDPORTION OF PENSION AFTER 10YEARS

Dated 03.09.2024 : In social media , it was widely reported that same retirees had filed writ petitions in various court pleading for restoration of commuted pension . It was also reported that such petitions have met with success and courts had reduced the period of recovery of commuted portion from 15 years to around 10 to 2 years .

Hence many retirees and retiree associations have shown interest in filing such petitions . In order to help such retirees and retiree associations desiring of moving the courts , All India Bank Pensioners & Retirees Confederation ( AIBPARC ) has issued a circular guiding them how to file such petitions .

The guidelines are reproduced below :

*GENERAL GUIDELINES TO FILE WRIT PETITION FOR RESTORATION OF COMMUTATION AFTER EXPIRY OF TEN YEARS FROM THE DATE OF COMMUTATION*

1. DETAILS TO BE FURNISHED BY THE RETIREE (in the following format)

i) Name……

ii) Employee No./Roll No.

iii) Designation at the time of Joining Bank and at the time of Retirement from Bank

iv) Date of Joining Bank (Name of Bank)

v) Date of Retirement from Bank

vi) Date of Commutation of a portion of Pension

vii) Branch from which retired

viii) Pension Payment Order No…….(copy enclosed- self attested)

ix) Pension Drawing Branch……..

x) Present Residential Address

xi) Aadhaar Card No……….(copy enclosed -self attested)

xii) Photo

xiii) Signature

xiv) Membership No. Allotted by PENSIONERS’ ASSOCIATION.

Notes for Pensioners Association

1. CERTIFIED COPY OF THE RESOLUTION

The Executive Committee of the …………. (Name of the Pensioners Association) In its meeting held on ……….. (Date) Unanimously decided to file a Writ Petition in the Hon’ble High Court of …………. (Place) for restoration of the Commuted Portion of the Basic Pension after the expiry of a period of ten years from the date of Commutation on behalf of its all the eligible members. It was further resolved to authorise Shri………. aged about……. Years son of Shri………………. retired from the services of …………… Bank as ………… (Designation) and presently residing at …………………. (address) and also holding the post of ……………… in the ……………… (Name of Pensioners Association).Shri …………….. is authorised to represent …………………. (Pensioners Association) Before the Hon’ble High Court, sign necessary Vakalatnama, Affidavits and other related papers/documents and exhibits as required by the lawyer and the Hon’ble High Court. Shri……………….. Is also authorised and empowered to present himself personally before the Hon’ble High Court to represent ………………. (Pensioners Association) as and when required. Signed on this …… day of September, 2024.

PRESIDENT GENERAL SECRETARY

2. COPY OF THE REGISTRATION CERTIFICATE OF THE PENSIONERS’ ASSOCIATION

3. COPY OF THE BYE-LAWS/CONSTITUTION/RULES & REFULATIONS

4. *RELEVANT PROVISION OF THE BANK EMPLOYEES’ PENSION REGULATIONS 1995 for Lawyer’s Reference

5. OTHER INFORMATION AS REQUIRED BY THE LAWYER.

Retirees desirous of filing writ petitions may contact their retiree associations to get further information .

BANK PENSIONERS DA WILL GO UP BY 23 SLABS FROM AUGUST 2024

Dated 06.08.2024 : In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from August 2024 to January 2025 will be enhanced by 23 slabs .New DA Rates for the pensioners retired earlier is as follows : Pensioners retired after 31.10 2022 : 17.20 % of Basic Pay

1. Pensioners retired after 31.10 2017 : 50.12 % of Basic Pay ( 716 slabs over 6352 points )2. Pensioners retired between 01.11.2012 to 31.10 2017 : 119.40% of Basic pension ( 1194 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 239.25 % of Basic pension ( 1592 slabs over 2836 points)2. Pensioners retired between 01.11.2002 to 31.10 2007 : 311.76 % of Basic pension ( 1732 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 : a. Up to Basic pension Rs 3,550 : 451.92 % + Rs 800

b. Basic pension between Rs 3,551 to Rs 5,650 : 451.92 % + Rs 450c. Basic pension between Rs 5,651 : 451.92 %

Similarly the pensioners retired earlier will also get DA enhancement . To read IBA circular in this regard , CLICK HERE

To read AIBEA Circular , click here

PENSION OPTION FOR BANK RESIGNEES

Dated 17.03.2024 : In the month of November 2023 , Indian Bankers Association ( IBA ) had signed a MOU with regard to providing option for bank resignees to opt for receiving monthly pension . The MOU implementation will be subject to Government approval .

Now the Department of Financial services , Ministry of Finance has conveyed their ‘No Objccti‹›n’ for Extending an option of pension to the resignees who were otherwise eligible to join the Pension Scheme under the Bank Employees Pension regulations but were not offered second option to join the pension scheme as they had resigned.

Following categories of resignees will be eligible for joining the pension scheme :

1. Employees and officers. who were in service of the Banks on or after 1st, January 1986 and had joined the Banks before 1st , April 2010 and who have resigned from the service of the Bank on or before 26th , April 2010 and who were otherwise eligible to join the pension scheme while in service and In case of death after resignation, the surviving spouse or eligible family member can opt. (they will get family pension) . They should have completed 20 years service and above at the time of resignation

2. They should agree to refund to the Bank the entire Bank’s contribution to Provident Fund (along with accumulated interest thereon) received by them at the time of their resignation from the Bank. (No additional interest thereon

On signing an agreement with the bank and refunding PF amount with interest , resignees or their surviving spouses will be eligible to receive pension prospectively . However they will not be eligible for commutation of their pension .

Pension Payable : 50% of Pay if completed 33 years service at the time of resignation. Other cases (20 to 32 years) : 50% of Pay x service I 33. Pension/Family pension payable prospectively. No facility of commutation

Monthly ex-gratia for bank pensioners :

EX-GRATIA FOR BANK PENSIONERS – QUANTUM FIXED

Dated 08.03.2024 : In the bipartite settlement signed today between IBA and UFBU , the quantum of ex-gratia fixed for the bank retirees is Full basic pension + DA for October 2022 multiplied by a factor below and rounded of to the nearest 100

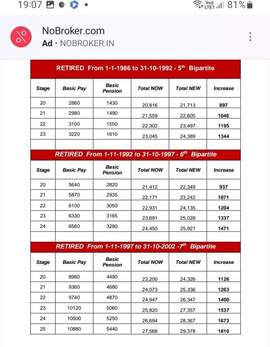

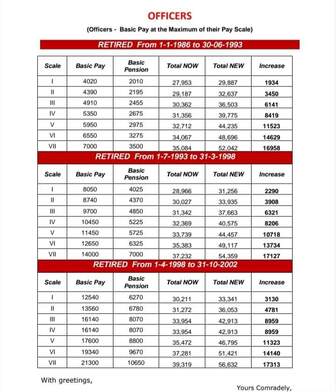

FACTOR TABLE :

AWARD STAFF :

1. 4TH / 5TH BPS Retired between 01.01.1986 to 31.10.1992 – Factor 0.17 2. 6TH BPS Retired between 01.11.1992 to 31.03.1998 – Factor 0.15

3. 7TH BPS Retired between 01.04.1998 to 31.10. 2002 – Factor 0.12 4. 8TH BPS Retired between 01.11.2002 to 31.10. 2007 – Factor 0.07

5. 9TH BPS Retired between 01.11.2007 to 31.10. 2012 – Factor 0.056. 10TH BPS Retired between 01.11.2012 to 31.10. 2017 – Factor 0.03

7. 11TH BPS Retired between 01.11.2017 to 31.10. 2022 – Factor 0.02

FOR OFFICERS :

1. 1ST / 2ND JN Retired between 01.01.1986 to 30.06.1993 – Factor 0.17 2. 3RD JN Retired between 01.07.1993 to 31.03.1998 – Factor 0.15

3. 4TH JN Retired between 01.04.1998 to 31.10. 2002 – Factor 0.12 4. 5TH JN Retired between 01.11.2002 to 31.10. 2007 – Factor 0.07

5. 6TH JN Retired between 01.11.2007 to 31.10. 2012 – Factor 0.056. 7TH JN Retired between 01.11.2012 to 31.10. 2017 – Factor 0.03

7. 8TH JN Retired between 01.11.2017 to 31.10. 2022 – Factor 0.02

BANK PENSIONERS DA WILL GO UP BY 61 SLABS FROM FEBRUARY 2024

Dated 01.02.2024 : The average consumer index points have increased in the quarter ending December 2023 to 9,122.33 from earlier average of 8,881.28 points in June 2023 . Accordingly the DA slabs have gone up by 61 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2024 to July 2024 will be enhanced by 61 slabs .New DA Rates from February 2024 to July 2024 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 48.51 % of Basic Pay ( 693 slabs over 6352 points )2. Pensioners retired between 01.11.2012 to 31.10 2017 : 117.10% of Basic pension ( 1171 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 235.80 % of Basic pension ( 1572 slabs over 2836 points)2. Pensioners retired between 01.11.2002 to 31.10 2007 : 307.62 % of Basic pension ( 1709 slabs over 2288 points )

3. Pensioners retired between 01.04 .1998 to 31.10 2002 : a. Up to Basic pension Rs 3,550 : 446.40 % + Rs 800

b. Basic pension between Rs 3,551 to Rs 5,650 : 446.40 % + Rs 450c. Basic pension between Rs 5,651 : 446.40 %

Similarly the pensioners retired earlier will also get DA enhancement .

To read AIBEA Circular , click here

” EX-GRATIA FOR BANK PENSIONERS DECIDED ” :

Dated 13.01.2024 : Yesterday 12.01.2024 late night , IBA signed cost sheet with UFBU representatives. The cost sheet allocates funds needed for various components of the agreement . It is reported that cost of monthly ex-gratia amount payable to bank pensioners is also taken in to account for working out the cost sheet .

Mr C.H.Venkatachalam , General secretary of AIBEA has tweeted that ” Ex gratia for pensioners has also been decided ” . However the formula for granting ex-gratia and total cost is not yet revealed . The information will be divulged only after signing of the settlement which is expected to take place in the next week .

The anxious pensioners are left to guess the quantum of ex-gratia and arrears . Many pensioners are not happy with the ad-hoc ex-gratia while they expected regular updation of their pensions .

MONTHLY EX-GRATIA FOR BANK PENSIONERS :

Dated 08.12.2023 : In the MOU signed with UFBU yesterday , IBA has agreed to consider monthly ex-gratia amount along with pension by PSBs to pensioners and family pensioners, who were drawing pension as on 31/10/2022. The applicability of the said ex-gratia for the retirees of the current settlement period will be discussed further. The said ex-gratia amount will not attract any other allowance including dearness allowance. This is a one-time measure applicable for the current bipartite / Joint Note period and it’s Without prejudice to the demand of unions/associations for updation of pension for all retirees .

However quantum and the modalities for payment are to be discussed while finalizing the 12th bipartite salary negotiations .

SBI PENSIONERS TO GET PENSION AT 50 % COMPUTATION :

Dated 14.11 2023 : It is reported that Government of India has approved computation of pension at uniform 50 % rate for all the pensioners of State Bank of India . GOI has directed the bank to make necessary modification in its regulations to complete the process .

The existing pension computation formula is as follows , Which is going to be amended now :

(a) No. of years pensionable service x Average substantive salary drawn during the last 12 months’ pensionable Service (not to be rounded off)

(b) (i).Where the average of monthly substantive salary drawn during the last 12 months’ pensionable service is upto Rs. 51,490/- p.m. : 50% of the average of monthly substantive salary drawn during the last 12 months’ pensionable service + ½ of PQP + 1/2 of incremental component of FPP, wherever applicable. (ii).Where the average of monthly substantive salary drawn during thelast 12months’pensionable service is above Rs. 51,490/- p.m. :

40% of the average of monthly substantive salary drawn during the last 12 months’ pensionable service subject to minimum of Rs. 25,745/- + ½ of PQP + ½ of incremental component of FPP, wherever applicable.

In the case of (b)(i) : Lower of (a) and (b)(i) will be the basic Pension. In the case of (b)(ii) : Lower of (a) and (b)(ii) will be the basic Pension.

PENSION OPTION FOR BANK RESIGNEES

Dated 10.11.2023 : Memorandum of Understanding has been signed between the representatives of UFBU and IBA with regard to providing option for bank resignees to opt for receiving monthly pension . The MOU implementation will be subject to Government approval

Following categories of resignees will be eligible for joining the pension scheme :

1. Employees and officers who were in service between 01.01.1986 and 01.04.2010 and have resigned from the services of the banks before 26.04.2010 and who were otherwise eligible for pension

2. Who are agreeable to refund the entire Provident fund along with interest .

On signing an agreement with the bank and refunding PF amount with interest , resignees or their surviving spouses will be eligible to receive pension prospectively . However they will not be eligible for commutation of their pension . .

To read complete details of MOU , you may go through AIBEA circular by clicking here

IBA WORKING OUT FOR PENSION IMPROVEMENT : UFBU

Dated 10.11.2023 : IBA has informed United Forum of Bank unions ( UFBU ) , in the negotiation meeting held yesterday that they are working out for improvement of pensions , keeping the cost implications of the exercise . It is expected that all the bank retirees from 01.01.1986 up to 31.10.2022 will be benefitted by the IBA move .

The above information is disclosed by AIBEA in their circular dated today

PRE 2002 BANK PENSIONERS : Dearness Allowance Rates from October 2023

Dated 15.10.2023 : Consequent to 100 % neutralization of Dearness Allowance to pre 2002 bank retirees , the new DA rates effective from October 2023 till January 2024 will be as follows :

1. Retired staff between 01.01.1986 to 31.10.1992 and officers retired before 30.06.1993 – DA Rate of 1386.90 % of the basic pay

2. Retired staff between 01.11.1992 to 31.03.1998 and officers retired before 01.07.1993 to 31.03.1998 – DA Rate of 676.55 % of the basic pay

3. Retired between 01.04.1998 to 31.10.2002 for both staff and officers – DA Rate of 431.76 % of the basic pay

PRE 2002 BANK PENSIONERS :Neutralization of Dearness Allowance

UPDATE DATED 07.10.2023 : Ministry of Finance , Government of India has cleared the proposal of IBA for granting uniform 100 % neutralization of DA to pre 2002 bank retirees . The effective date is 01.10.2023 . The pension will be revised from October 2023 and no arrears will be payable for earlier period . It is reported that MOF has already informed the clearance to IBA and have asked them to instruct the bank managements suitably .

PRE 2002 BANK PENSIONERS :Neutralization of Dearness Allowance

UPDATE DATED 04.10.2023 : It has been reported that Ministry of Finance , Government of India has cleared the proposal of IBA for granting uniform 100 % neutralization of DA to pre 2002 bank retirees . Now official instruction from IBA is awaited

Dated 28.07.2023 : UFBU has today signed an agreement with IBA for. the revision of Dearness Relief ( D A ) from staggered four slab to uniform 100 % neutralization for all those retirees who retired from the bank’s services up to 31.10.2002 .

DA will be rates will be on uniform basis of 100 % neutralization as in the case of employees / officers / pensioners / family pensioners of period on and from 1st, November 2002 as provided herein below :

For the pensioners / family pensioners of period 01.01.1986 to 31.10.1992 , DA shall be taken. at the uniform rate of 0.67 % per slab over 600 points .

For the pensioners / family pensioners of period 01.11.1992 to 31.10.1997 , DA shall be taken. at the uniform rate of 0.35 % per slab over 1148 points .

For the pensioners / family pensioners of period 01.11.1997 to 31.10. 2002 , DA shall be taken. at the uniform rate of 0.24 % per slab over 1684 points .

Further following ex-gratia is also agreed up on :

For the pensioners / family pensioners of period 01.01.1986 to 31.10.1992

a. For basic pension / family pension up to Rs 1250 , ex-gratia of Rs 800/ – per month b. For basic pension / family pension above Rs 1250 , ex-gratia of Rs 450/ – per month

For the pensioners / family pensioners of period 01.11.1992 to 31.10.1997.

a. For basic pension / family pension up to Rs 2,400 , ex-gratia of Rs 800/ – per month b. For basic pension / family pension above Rs 2,400 , ex-gratia of Rs 450/ – per month

For the pensioners / family pensioners of period 01.11.1997 to 31.10. 2002

a. For basic pension / family pension up to Rs 3,550 , ex-gratia of Rs 800/ – per month b. For basic pension / family pension above Rs 3,550 , ex-gratia of Rs 450/ – per month

To read UFBU circular on the issue. , CLICK HERE

BANK PENSIONERS DA WILL GO UP BY 44 SLABS FROM AUGUST 2023

Dated 31.07.2023 : The average consumer index points have increased in the quarter ending June 2023 to 8881.28 from earlier average of 8,706 points . Accordingly the DA slabs have gone up by 44 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from August 2023 to January 2024 will be enhanced by 44 slabs .New DA Rates from August 2023 to January 2024 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 44.24 % of Basic Pay ( 632 slabs over 6352 points )2. Pensioners retired between 01.11.2012 to 31.10 2017 : 111.00% of Basic pension ( 1100 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 226.65 % of Basic pension ( 1511 slabs over 2836 points)2. Pensioners retired between 01.11.2002 to 31.10 2007 : 296.64% of Basic pension ( 1648 slabs over 2288 points ) 3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 431.76 % b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 359.80 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 215.88 % of Basic pension exceeding Rs 5,650 d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 107.94 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

PENSION OF RBI RETIREES REVISED

Dated 14.07.2023 : Reserve Bank of India has revised the pension payable to its pensioners who retired before 01.11.2017.

As per the revised pension ,basic pension will be revised by a factor of 1.63 ( basic pension of Rs 100 will become 163 ) from the month of June 2023. DA will be paid on the basis of CPI 6352. No arrears will be paid for the earlier periods.

AIBPARC DELEGATION MEETS FINANCE MINISTER :

UPDATE DATED 21.06.2023 : As per a circular issued by AIBPARC , their delegates during the meeting on 19th , June 2023 with the FM , raised the following long pending issues :

(1) Pension updation for all eligible Pensioners

(2)100 per cent DA neutralization for Pre-November 2002 Retirees(3) Medical insurance premium to be borne by the banks. Alternatively, a new scheme akin to CGHS may be

introduced by collecting one time contribution from the beneficiaries.(4) Reckoning of Special Allowance introduced wef 01.11.1012 for calculation of gratuity and pension.

(5) One more option for pension to all the eligible Resignees and left outs.(6) Formal consultative status for the Pensioners organisations.

As Government of India is the principal stake holder of the Banks, AIBPARC delegates requested for her intervention for earlyresolution of the long pending issues.

The delegates also submitted a memorandum to the Hon’ble Finance Minister. She directed the officials present in the meeting to ensure that IBA looks into the demands seriously and makes a detailed presentation to her early next week on all the issues contained in our memorandum.

DATED 20.06.2023 : Yesterday , a delegation of All India Bank Pensioners & Retirees Confederation (AIBPARC) led by President Shri K.V. Acharya ,met the Finance minister Smt Nirmala Sitaraman . AIBPARC delegation comprised of Dr.J.D .Sharma , Sri Suprita Sarkar and and Mr G.V.V.S.N. Varma The delegation presented the long pending issues that are bothering the Retirees and again requested her for an early resolution of the same. Senior Officials of the Ministry were also present during the discussion..

In the mean time , Moneycontrol.com has reported that the FM has directed IBA , as a follow up action after the meeting , to look in to the pending issues of the bank retirees and report to her within seven days ( as told to them by Sri K.V Acharya ) .

BANK PENSIONERS DA WILL GO UP BY 62 SLABS FROM FEBRUARY 2023

Dated 31.01.2023 : The average consumer index points have increased in the quarter ending June 2022 to 8705.98 from earlier average of 8,495 points . Accordingly the DA slabs have gone up by 62 slabs .

In tune with raising Consumer Price Index noted , the Dearness Allowance ( DA ) payable to bank pensioners from February 2023 to July 2023 will be enhanced by 62 slabs .New DA Rates from February 2023 to July 2023 for pensioners retired earlier is as follows :

1. Pensioners retired after 31.10 2017 : 41.16 % of Basic Pay ( 588 slabs over 6352 points )2. Pensioners retired between 01.11.2012 to 31.10 2017 : 106.60 % of Basic pension ( 1066 slabs over 4440 points )

1. Pensioners retired between 01.11.2007 to 31.10 2012 : 220.05 % of Basic pension ( 1467 slabs over 2836 points)2. Pensioners retired between 01.11.2002 to 31.10 2007 : 288.72 % of Basic pension ( 1604 slabs over 2288 points ) 3. Pensioners retired between 01.04 .1998 to 31.10 2002 :

a. Up to Basic pension Rs 3,550 : 421.20 % b. Basic pension between Rs 3,551 to Rs 5,650 : Rs 13,325.28 + 351.00 % of Basic pension exceeding Rs 3,550

c. Basic pension between Rs 5,651 to Rs 6,010 : Rs 19,894.08 + 210.06 % of Basic pension exceeding Rs 5,650 d. Basic pension above Rs 6,010 : Rs 20,569 .72 + 105.30 % of Basic pension exceeding Rs 6,010

Similarly the pensioners retired earlier will also get DA enhancement .

To know about working bankers DA hike , click here

To read AIBEA Circular , click here

DISCLAIMER

Use of the information at this site www.plannprogress.com is at one’s own risk. We do not offer to sell or solicit to buy any financial instruments including Deposits , Loans whether short term or otherwise , Mortgages , Stocks , Insurance or Mutual Funds .This site does not offer to sell or solicitation to buy any securities and we will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein are purely for educational purposes and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice.

Entry to this site is free of charge and we do not charge any fees what so ever . No need for registration for viewing the site . All content and information is provided on an ‘As Is’ basis by us. Information herein is believed to be reliable, but does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. As a condition to accessing http://www.plannprogress.com content and website, you agree to our Terms and Conditions of Use, Privacy policy & Disclaimer available on the links . The performance data quoted represents past performance and does not guarantee future results.

Articles/ Pages in this site contain advertisements and links to various third party sites / blogs as we have found articles therein interesting and useful and we believe reliable . Those links sites and advertisements may contain offer of sales or services of various kinds including financial services . We accept no responsibility for the accuracy , correctness and/or completeness of any information contained therein as we have not independently verified. The links and third party advertisements are governed by the privacy policy of those third party sites / blogs. We do not warrant or guarantee for any services or sales utilized therein . This site expressly disclaims all warranties and conditions of any kind, whether express or implied. However readers are advised to exercise their discretion in utilising / following any advice contained therein or utilizing any services or accepting their sales or any other offers and we do not take any responsibility what so ever.

The site is governed by Indian Laws and comes within the jurisdiction of courts in Mysuru , Karnataka , India

Contact Information : The site www.plannprogress.com is owned and operated by Mr . Manjunathan B.N. , No 37, 5thBlock , Madhuvana Layout , Sriramapura 2nd stage , Mysuru 570023 , Karnataka , India and can be contacted at email : info@plannprogress.com

Copyright © PlannProgress – All Rights are Reserved | Powered by PixelFlare

This website uses cookies to provide necessary site functionality and to improve your experience. By using this website, you agree to our use of cookies.