IMPORTANT BANKERS NEWS

EXCLUSIVE NEWS FOR BANKERS BANK PENSIONERS NEWS /BANK RETIREES NEWS

For the benefit of our Bank retiree readers , who are in large number following us on Facebook , we have created a new page exclusively having News for Bank Pensioners . The news pertaining to retirees and pensioners has been moved to the new page . All future news / articles for Bank Retirees / pensioners will published on the new page and you can read by clicking here

News Flash :Nationwide General Strike – February 12, 2026

30 Crore Workers Join Mega General Strike; Banking and Transport Hit Across India

Dated 12.02.2026 : The nationwide general strike (Bharat Bandh) called by a joint platform of 10 Central Trade Unions and the Samyukta Kisan Morcha (SKM) is in full swing today. Reports from across the country indicate a massive turnout, with union leaders estimating participation from nearly 30 crore workers across industrial, service, and agricultural sectors.

Key Impacts

- 🏦 Banking Services: Public Sector Banks (PSBs) are seeing significant disruptions. Major unions like AIBEA and AIBOA have joined the strike, stalling branch operations, cash transactions, and cheque clearances.

- Note: Private banks and digital services (UPI/Net banking) remain largely functional.

- 🚌 Public Transport: A near-total shutdown of public transport is reported in Kerala, Odisha, and Assam. In other states like Punjab, Haryana, and Tamil Nadu, bus services are partially suspended, and “chakka jams” (road blockades) are occurring on major highways.

- ⚡ Essential Services: While the NCCOEEE (Electricity Employees) is participating, they have ensured that essential grid operations are maintained. However, routine maintenance and billing offices are closed.

- 🚜 Farmers’ Participation: Farmers have blocked several state and national highways to protest the India-US Interim Trade Deal and demand a legal guarantee for MSP.

- 🏫 Schools & Offices: Most government offices report thin attendance. Schools in high-impact states (Kerala, Odisha) are closed, though many in West Bengal and Karnataka remain open with normal turnouts.

Why the Strike? (The Core Demands)

The protesters are demanding:

- Repeal of 4 Labour Codes which they claim erode job security.

- Withdrawal of the VB-GRAM G Act and restoration of the original MGNREGA.

- Opposition to Privatization of Public Sector Banks and the Visakhapatnam Steel Plant.

- Scrapping of the SHANTI Act and the Electricity (Amendment) Bill 2025.

Service | Status | Impact Level |

Public Sector Banks | Partially Functional / Staff on Strike | High |

Private Banks / ATMs | Operational | Low |

State Transport (Buses) | Shut in Kerala, Odisha, Assam | High |

Railways / Flights | Running (Minor delays getting to stations) | Low |

Hospitals / Pharmacy | Fully Operational (Exempted) | None |

BANK UNIONS TO JOIN GENERAL STRIKE

Dated 02.02.2026 : Leading bank unions like AIBEA , AIBOA & BEFI are going to join a general strike called by various trade unions on the 12th , February 2026 .

The strike is being organized by a joint platform of ten Central Trade Unions (CTUs) and various independent sectoral federations. It is expected to see significant participation across industrial, public, and agricultural sectors.

Key Details of the Strike

- Date: February 12, 2026.

- Participating Unions: INTUC, AITUC, HMS, CITU, AIUTUC, TUCC, SEWA, AICCTU, LPF, and UTUC.

- Supported by: The Samyukta Kisan Morcha (SKM), representing various farmers’ organizations, and the National Coordination Committee of Electricity Employees and Engineers (NCCOEEE).

- Notable Exception: The Bharatiya Mazdoor Sangh (BMS) has explicitly stated it will not participate, viewing the strike as politically motivated.

Primary Demands and Issues

The unions have called for the strike to protest several recent legislative changes and government policies:

- Repeal of Labour Codes: Opposition to the four new Labour Codes, which unions argue weaken worker protections and make union registration more difficult.

- Employment Rights: Protesting the replacement of MGNREGA with the Viksit Bharat – Guarantee for Rozgar and Ajeevika Mission (Gramin) Act, 2025 (VB-GRAM G).

- Energy Sector Changes: Opposition to the SHANTI Act (related to nuclear energy) and the Electricity (Amendment) Bill, 2025, citing concerns over privatization and liability.

- Economic Demands: Demands for a statutory Minimum Support Price (MSP) for farmers, filling vacant government posts, and stopping the privatization of Public Sector Undertakings (PSUs).

Potential Impact

You should expect disruptions in the following areas on February 12:

- Banking and Insurance: Many bank employee federations have endorsed the call.

- Public Transport: Road transport unions in several states are likely to participate.

- Electricity and Power: Sector-specific strikes by engineers and employees may affect services.

- Government Offices: The Confederation of Central Government Employees and Workers has served a formal strike notice.

Why are they striking?

While the strike is part of a larger national movement, bank unions have highlighted several specific grievances:

- Opposition to Labour Codes: They argue the new codes make it easier for employers to terminate staff (specifically in establishments with under 300 workers) and make union registration more difficult.

- 5-Day Work Week: This remains a major point of contention. Although the Indian Banks’ Association (IBA) recommended a 5-day week in 2024, the unions are striking because the government has yet to provide final approval.

- Privatization: The unions are protesting the proposed privatization of Public Sector Banks (PSBs).

- Working Conditions: Protests against fixed-term employment and the push for increased daily working hours.

Expected Impact on Banking

- Public Sector Banks (PSBs): Services at banks like SBI, PNB, and Bank of Baroda are likely to be significantly impacted. Expect disruptions in cash deposits/withdrawals, cheque clearances, and branch-level administrative work.

- Private Sector Banks: Major private lenders (HDFC, ICICI, Axis) typically remain unaffected as their employees are generally not members of these particular unions.

- Digital Services: UPI, net banking, and mobile apps should continue to function normally, though there may be localized ATM cash shortages due to logistical delays.

Note: This strike on Feb 12 follows a separate bank-specific strike that occurred on January 27, 2026, specifically regarding the 5-day work week demand

BANKERS DA TO INCREASE BY 1.07 % FROM FEBRUARY 2026

Dated 31.01.2026 : The Dearness Allowance on the salary of bankers is set for an increase of 1.07 % from February 2026, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 25.00 % . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to April 2026 and will be reviewed thereafter.

To read AIBEA circular on the subject, CLICK HERE

BANKERS STRIKE TODAY – DEMAND FOR 5 DAYS BANKING PER WEEK

Dated 27.01.2026 : The nationwide strike called by UFBU is fully active today, Tuesday, January 27, 2026.

Public sector bank branches across India are seeing massive participation, leading to a complete standstill in physical services like cash handling and cheque clearances. Since this follows the fourth Saturday , Sunday and Republic Day holidays, it marks the fourth consecutive day of closed branch counters.

The United Forum of Bank Unions (UFBU), which represents nine major bank unions, decided to proceed with the nationwide strike after a conciliation meeting with the Chief Labour Commissioner on January 23 failed to yield a resolution.

The primary driver for today’s action is the delay in implementing the 5-day work week. Although the Indian Banks’ Association (IBA) and unions signed a memorandum of settlement back in March 2024 agreeing to make all Saturdays holidays, the government has yet to issue the final notification.

The unions argue that bank employees have already agreed to work an extra 40 minutes daily on weekdays to compensate for the lost hours, yet the reform remains stuck in the approval phase.

Key Impact Today:

- Public Sector Banks Affected: Operations at most public sector banks are likely to be significantly disrupted. This includes branch-level services such as cash transactions, cheque clearances, and administrative work.

- Four-Day Gap: Because today’s strike follows a Fourth Saturday ( January 24 ), a Sunday (January 25) and the Republic Day holiday (Monday, January 26), most public sector branches have now been effectively closed to the public for four consecutive days.

- Private Banks: Large private sector lenders like HDFC Bank, ICICI Bank, and Axis Bank are generally expected to function normally, as their employees are not typically part of the unions involved in this strike.

- Digital Services: Online banking, UPI, and mobile apps are expected to remain operational, though some ATMs might face cash shortages due to the extended closure and lack of restocking staff.

READ OUR ARTICLE : WORKLIFE BALANCE & 5 DAYS BANKING

STRIKE CALL STANDS:

Dated 15.01.2026 : In response to a notice issued by UFBU , Indian Bankers Association ( IBA ) had invited the representatives of UFBU for a reconciliatory meeting yesterday the 14th , January, 2026, and to discuss the demands made by the UFBU in their strike notice.

IBA requested UFBU to postpone the agitational programme, as they are pursuing with the government for the implementation of the agreement already reached. However, UFBU didn’t agree to defer the agitation and strike call as the deal is pending with the government for more than 2 years without any positive movement.

Hence the call for an all India strike on 27th , January 2026 stands .

To read UFBU circular, CLICK HERE

Bankers to go on STRIKE : IBA CALLS FOR A MEETING

Dated 13.01.2026: United Forum of Bank Unions ( UFBU ) . a group of bank employees unions and officers associations, have called for an one-day strike on 27th, January ,2026 pressing for their long-pending demand for 5 days banking per week.

In response to the notice issued by UFBU , Indian Bankers Association ( IBA ) has invited the representatives of UFBU for a reconciliatory meeting tomorrow at 2.30 pm at their Mumbai office, and to discuss on the demands made by the UFBU in their strike notice

Bankers to go on STRIKE :

5 DAYS BANKING PER WEEK

Dated 05.01.2026: United Forum of Bank Unions ( UFBU ) . a group of bank employees unions and officers associations, has called for a day’s strike on 27th, January ,2026 pressing for their long-pending demand for 5 days banking per week.

History of the demand: In the 10th Bipartite Settlement / 7th Joint Note signed in 2015, it was agreed that 2nd and 4th Saturdays of every month will be holidays and in lieu of that the remaining Saturdays will be full working days.

In the negotiations for the 11th Bipartite Settlement/ 8th Joint Note, we pursued our demand for declaring the remaining Saturdays also as holidays. But it could not be materialized at that time, as our settlement was signed during the covid pandemic period. Hence the issue was again taken up during the negotiations for the 12th Bipartite settlement / 9th Joint Note. After a lot of discussion, IBA agreed as under in the MOU signed on 7-12-2023.

Regarding introduction of 5 Day Banking, while IBA has already recommended the same to the Government, IBA agreed to pursue the matter with the Government so that the same is cleared without further delay.

Weekly off In terms of understanding dated 7th December, 2023, reached between IBA and Workmen Unions for declaration of all Saturdays as holidays under Negotiable Instrument Act for Banking industry, IBA has accordingly recommended to the Government. The due changes in the working hours, will be effective after approval by the Government of India and necessary clearances from Government / Reserve Bank of India. Thus, it is two years since the issue was recommended to the Government for approval.

In the financial sector, this has already been implemented at the RBI, LIC, and GIC. Hence, bank employees and officers are aggrieved that they are being discriminated against, while it is stressful to work in the Banks.

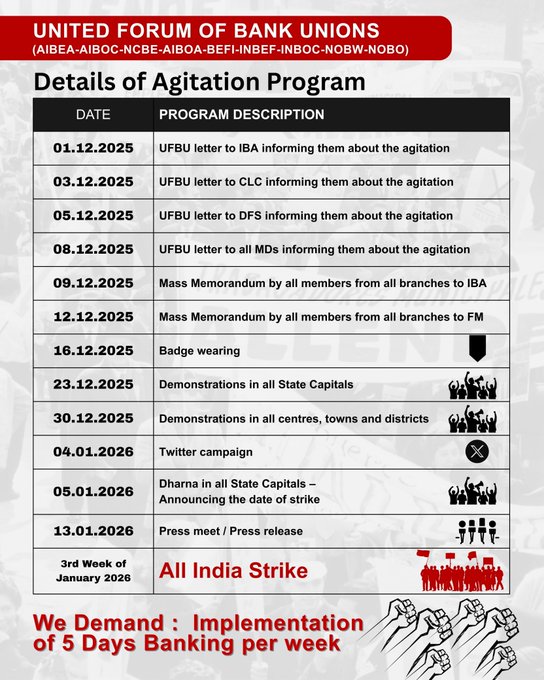

Pressing for their demand for implementation of 5 days banking plan , bankers went for an agitation during December 2025 . They conducted demonstrations in State capitals , Twitter campaign ,etc . As bankers didn’t get a positive response from the government, bankers are planning to go on strike

RECRUITMENT OF STAFF IN BANKS IS IMPROVING : UFBU

Dated 13.12.2025 : United Forum of Bank Unions ( UFBU ) had taken up with Indian Bankers Association ( IBA ) and Department of Dinancial Services ( DFS ) , the issue of scarcity of staff in Banks and need to increase the number of staff to be recruited .

It was also one of the issues taken up in the strike notice issuedby them in 2025 and the Chief Labour Commissioner has been holding series of conciliation meetings to discuss the issues raised by UFBU. During the conciliation meeting, IBA informed that recruitment of clerical staff is stepped up in the coming years

Banks had placed an Indent for 10,277 clerks for the year 2026- 27 which is increased to 13,533. Recently this has been further increased to 15,701. SBI also placed their Indent for 6589 clerks. Thus the total recruitment of clerks for the next year has gone upto 22,290.

During the conciliation meeting, UFBU requested for revision of the sequence of recruitment process . So far, IBPS has been announcing the results of clerical recruitment and thereafter, the results for recruitment of Probationary Officers. Because of this, many candidates who appeared in both the examinations, first joined the banks as clerks and when later they get selected as POs, they were resigning the clerical job resulting in huge attrition.Hence UFBU suggested a change in the sequence of announcing the results

UFBU suggested that the results of the examination for recruitment of POs in SBI, Nationalised Banks and RRBS to be first released and thereafter release the list of results of clerical recruitment so that the attrition level can be reduced. The DFS (Finance Ministry) is reported to have agreed with the UFBU suggestion.

To read the AIBEA circular on the issue, CLICK HERE

Bankers to go on an agitation programme :

5 DAYS BANKING PER WEEK

Dated 03.12.2025 : United Forum of Bank Unions ( UFBU ) . a group of bank employees unions and officers associations, has called for an agitational programme , pressing for their long-pending demand for 5 days banking per week.

AGITATIONAL PROGRAMME :

DFS MEETS UFBU AND DISCUSSES NEW LABOUR CODES

Dated 27.11.2025 : Today Department of Financial Services (DFS) held a meeting with UFBU representatives in their office in New Delhi.

The meeting was conducted by DFS to understand the concerns of Labour Unions with regard implementation of the four Labour Codes in replacement of the 29 existing labour laws . A Gazette notification has already issued by the Government on 21-11-2025 .

From DFS, Mr. M Nagaraju, Secretary, along with Ms. Shalini Pandit, Joint Secretary, Mr. Mohd. Ashraf, Dy. Secretary, Mr. Sanjeev Kumar Mishra, Under Secretary and Mr. V.S. Tiwari, Under Secretary participated in the meeting .

UFBU informed the DFS that while improvements and changes in the labour laws are necessary according to changing needs and aspirations, the same have to be undertaken in consultation with the Central Trade Unions.UFBU also pointed out that while the Labour Code talks of payment of gratuity after one year’s service, Unions are demanding for increasing the limit to Rs. 25 lacs. UFBU further said that while some of the provisions and procedures under the existing labour laws need simplification, it should not result in dilution of any of existing labour rights.

UFBU reiterated their view that the Labour Ministry should engage in discussion with the Central Trade Unions and ensure that any change in labour laws is undertaken after due consultation process.

UFBU also brought to attention of DFS of pending issues like implementation of 5 Days Banking, filling up of posts of Workman and Officer Directors in PSBs, adequate recruitments of clerical, substaff and security staff in the Banks, updation of pension, premium on Group Medical insurance Policy for retirees to be borne by Banks, etc.

To read UFBU circular in this regard, CLICK HERE

BANKERS DA TO INCREASE BY 2.80 % FROM NOVEMBER 2025

Dated 01.11.2025 : The Dearness Allowance on salary of bankers is set for an increase of 2.80 % from November 2025, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 23.93 % . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to January 2026 and will be reviewed thereafter.

To read AIBEA circular on the subject , CLICK HERE

MEETING OF UFBU WITH IBA ON 26-9-2025

Dated 27.09.2025 :A meeting was held yesterday between the representatives of IBA & UFBU .

The details of the meeting as circulated by UFBU : Further to the Strike Notice served by us on IBA on 5-3-2024, there have been few rounds of conciliation proceedings held by the Chief Labour Commissioner (Central), Ministry of Labour, Government of India. Various issues raised by UFBU in the Strike Notice have been under discussion during the conciliation meetings .

One of the important issues taken up by UFBU during these conciliation meetings was relating the PLI scheme advised by the Government applicable to Scale IV officers and above because this scheme was in total variance with the PLI scheme agreed in the Bipartite Settlement/Joint Note.

In the last round of conciliation meeting held on 11-8-2025, the CLC advised the Unions and IBA to discuss the issue bilaterally and submit the views so that the same be taken up for consideration by the Government. Accordingly, IBA had invited UFBU for discussions and a meeting was held between IBA and representatives of UFBU yesterday . After a lot of discussions, UFBU submitted that while the Government’s PLI formula may be implemented for the Top Management with certain modifications on the quantum of PLI, it should be ensured that no one should be denied of PLI as is payable under the bilateral PLI scheme applicable the employees and officers.

UFBU also suggested that the existing quantum of PLI as per scheme available under the settlement should be adequately improved upon.

IBA agreed and suggestions would be duly communicated to the CLC and DFS for their consideration and further discussions so that the issue can be amicably and bilaterally resolved. Issue will be further discussed in the ensuing conciliation meeting with CLC on 15th October, 2025.

Other issues: The following issues were also raised in the meeting.

- Early introduction of 5 day banking

- Finalising the details of Leave Bank scheme

iii.Implementation of Ex-gratia in all private banks

iv.Exemption of GST on Group Medical Insurance premium

V.Option for remaining employees/officers/retirees to join pension scheme

vi.Uniform DA rates for all pensioners at 8088 points

vii.Exemption of income tax on additional 4% of NPS contribution

viii.Increase in ceiling on Gratuity under the Act

ix.Recruitment of Substaff and Armed Guards

X.Advisory to Banks to advice Zonal/Regional Managers not to use abusive language on Branch Managers and others during meetings .

Discussions on these issues will be further continued in the next meeting. During the discussions, IBA informed that they have taken up the issue with DFS, CBDT and GST Council for exemption of income tax on the premium on Group Medical Insurance policy for retirees.

It was also mutually clarified that the new feature of Add-on facility under the Group Medical Insurance scheme for the retirees to include a dependent physically/mentally challenged family member would be applicable only to the children of the retirees.

IBA FIXES A MEETING WITH UFBU

Dated 25.09.2025 : A meeting with the members of the UFBU who have participated in the CLC meeting on 17/06/2025 & 11/08/2025 has been arranged by the IBA . Various ongoing issues will be discussed .

The meeting Date: Friday, 26th September 2025 , at 11.00 am onwards at the IBA office in Mumbai

The invitation for the meeting has been sent to the following associations / unions :

- All India Bank Employees’ Association – AIBEA

- All India Bank Officers Confederation – AIBOC

- National Confederation of Bank Employees – NCBE Bank Employees Federation of India –

- BEFI Indian National Bank Employees Federation –

- INBEF Indian National Bank Officers Congress –

- INBOC National Organisation of Bank Workers –

- NOBW National Organisation of Bank Officers – NOBO

CONCILIATION MEETING HELD BETWEEN IBA & UFBU , NO CONCRETE RESULT

Dated 11.08.2025 :A reconciliatory meeting was held today between the representatives of IBA & UFBU . The meeting was called by the Chief Labour Commissioner, New Delhi, in pursuance of an earlier meeting held on 17.06.2025.

At the very outset the Ld. Representative of IBA submitted the developments in the tune of the minutes of the meeting. As per him, meeting on the issues of recruitment and PLI held in Delhi on 10.08.2025 but nothing could be derived till now.

However, both the parties are discussing with the positive mind set and believe that some amicable solution can be arrived at. So far as security to the bank employees is concerned,DFS and IBA both have issued letters to the apex level of the State administration to take appropriate action so that the occurrences may not be repeated.

STAFF SECURITY : The union was also aware that DFS and IBA have taken steps to ensure security to the bank employees. However, they were of the view that banks management must recruit Armed Guards to the respective branches as per the provision of the bank. Unless such armed guards are recruited, such occurrences may not be stopped.

5 DAYS BANKING : The Representatives of unions were very much agitated on the issue of five days banking as Govt. has not yet arrived to any decision. They were pressing hard to allow them to use their ultimate right under the law 1.e. strike.

In view of the facts above, time to discuss the PLI and recruitment issues at bipartite level is extended with an advice to have at least one meeting in a month and endorse the copy of the minutes of such meeting to the CLC(C) for information. In respect of security, the managements of banks are advised through IBA to take appropriate steps as requested by the unions. So far five days banking is concerned CLC(C) has written a D.O. letter to the DFS to expedite the matter, it is decided to write a letter once again to the Secretary .

The next date of conciliation proceedings is fixed on 15.10.2025 at 11.30 AM.

BANKERS DA TO INCREASE BY 1.16 % FROM AUGUST 2025

Dated 01.08.2025 : The Dearness Allowance on salary of bankers is set for an increase of 1.16 % from August 2025, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 21.13 % . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to October 2025 and will be reviewed thereafter.

To read AIBEA circular on the subject , CLICK HERE

POSTPONEMENT OF PROPOSED BANK & INSURANCE STRIKE :

Date 17.05.2025: Various Unions in Banking and Insurance sector, had called for a nationwide General Strike on 20th May, 2025, to protest against the increasing onslaughts on the working class due the pro-corporate policies of the Government

Now given the prevailing tension in the country and the warlike situation, the unions have decided to postpone the called strike to 7th , July 2025

PROPOSED BANK & INSURANCE STRIKE :

Date 07.05.2025: At a meeting of the various Unions in Banking and Insurance sector, it was decided to jointly observe the nationwide General Strike on 20th May, 2025 to protest against the increasing onslaughts on the working class due the pro-corporate policies of the Government

The Strike call has been jointly given by AIBEA, AIIEA, AILICEF, AIBOA, BEFI and AINLIEF . Though other Unions like AIBOC, NCBE, INBEF, INBOC are not participating in the strike they have extended their fraternal support , The strike is to fully support the demands of the National Convention of Workers and to highlight the following demands:

- Strengthen Public Sector Banks and Insurance Companies

- Stop privatisation and disinvestment in Banks and LIC

- Stop 100% FDI Hike in Insurance sector

- Merge Public Sector General Insurance Companies as one entity

- Ensure adequate recruitments

- Stop outsourcing and contract jobs

- Scrap NPS – Restore OPS

- Take tough measures to recover bad loans from Corporates

- Reduce service charges in Banks for ordinary customers

- Withdraw GST on life and health insurance premiums

BANKERS DA TO DECREASE BY 1.23 %

Dated 01.05.2025 : The Dearness Allowance on salary of bankers is set for a decrease of 1.23 % from May 2025, as the Dearness Allowance ( DA ) payable to bank employees/officers has decreased to 19.97 % . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to July 2025 and will be reviewed thereafter .

To read AIBEA circular on the subject , CLICK HERE

PROPOSED BANKERS ‘ STRIKE DEFERRED

Date 21.03.2025: The adjourned conciliation meeting between UFBU , Banks and CLC took place today from morning. There was serious discussion on demands put up by UFBU.. Joint secretary of DFS spoke on video call to the participating members and informed about the positive discussion FM and DFS secretary had on the issue of 5 Day banking. Iba proposed to further discuss issues like recruitment and PLI and other issues. CLC informed that he will directly monitor the issues including implementation of 5 days banking. The meeting has been adjourned to be held again in the third week of April. In view of this positive development UFBU felt it necessary to postpone the proposed strike on 24th and 25th , March 2025 for a month or two. Hence proposed strike on 24th and 25th is postponed.

AIBEA OPPOSES NEW PLI FORMULA FOR THE SENIOR OFFICERS :

Dated 20.03.2025 : It is reported that the DFS, Finance Ministry had sent an unilateral modification of the Performance Linked Incentive Scheme ( PLI ) in November 2024 applicable to Scale IV officers and above. Earlier they were part of the Bilateral agreement signed between UFBU and IBA which was based on the collective performance of the Bank .

Now for the senior officers, PLI eligibility will depend up on the individual performance and the maximum eligible amount will be as follows :

For scale IV officers , 70% of Annual Basic Pay i.e. 255 days of Basic pay i.e. Rs. 11.75 lacs .

For scale V & VI officers, 80 % Annual Basic Pay i.e. 292 days of Basic pay i.e. Rs. 14.40 lacs

For scale VII officers , 90% Annual Basic Pay i.e. 328 days of Basic pay i.e. Rs. 22.50 lacs .

The new modified formula advised by DFS offers a huge jump in incentive amount to the senior officers , but based on individual performance .Hence some senior officers may not be eligible for any incentive , and AIBEA is opposing the scheme as they find the scheme

It is unilateral scheme by Government

It is violation of bilateral scheme agreed by IBA

It is nIt is discriminatory because majority will get lesser PLI and small section will get very huge PLI.ot inclusive, 1/5th of Scale IV-VIII officers will not be covered even if they are performers.,

It is discriminatory because majority will get lesser PLI and small section will get very huge PLI.

The Scheme provides that if the reputation of a Bank is affected say due to some fraud by outsides, the entire Bank will be ineligible for PLI and all Scale IV and above will not be paid PLI even though all of them are performers.

It is against basic stand of UFBU that collective performance should be the basis and not individual performance.

To read AIBEA Circular on the subject , CLICK HERE

PROPOSED BANKERS ‘ STRIKE : Reconciliation Fails

Date 19.03.2025: United Forum of Bank Unions . group of bank employees unions and officers associations, has called for a two days 48 hours continuous strike on 24th and 25th , March 2025 in support of their various demands. as mentioned here .

Adequate recruitment in all cadres, regularise all temporary employees

Implementation of 5 days banking

Withdrawal of DFS instruction on PLI scheme

Resolution of pending residual issues of bipartite agreements

Appointment of workmen / officers directors

Safety measures against assault / attack by the customers

Increase gratuity limit to Rs 25 lakhs.

Do not recover income tax on staff welfare benefits given to employees and officers on concessional terms. Managements to bear the same.

Maintain a minimum of 51% of Equity Capital in IDBI Bank by Government .

Based on the strike notice served by UFBU, the Chief Labour Commissioner, Ministry of Labour Govt. of India had called for a conciliation meeting in Delhi yesterday morning. UFBU was represented by all the constituent Unions. Representatives of IBA, DFS and all the Banks were present.IBA, DFS, and bank managements were present . Meeting discussed the strike issues . However there was no positive outcome on the issues , Hence UFBU has advised all their members to go ahead with the proposed strike

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represents bank employees unions and bank officers associations.

BANKERS DA TO INCREASE BY 1.37 % FROM FEBRUARY 2025

Dated 18 .02.2025 : The Dearness Allowance on salary of bankers is set for an increase of 1.37 % from February 2025, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 21.20% . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to April 2025 and will be reviewed thereafter

To read AIBEA circular on the subject , CLICK HERE

BANKERS TO GO ON STRIKE IN MARCH :

Date 08.02 .2025: United Forum of Bank Unions . group of bank employees unions and officers associations, has called for an agitational programme culminating in two days 48 hours continuous strike in support of their various demands. . Proposed strike dates are 24th and 25th , March 2025 .

The proposed agitational programme includes :

14.02.2025 : Evening time demonstration at major centres

16.02.2025 onward : Poster campaign at all branches/offices/Rly.stn/Bus stand/ public places

21.02.2025 : Evening time demonstration at major centres and District headquarters .

23.02.2025 : Social media campaign

28.02.2025 : Badge wearing

03.03.2025 : Dharna before Parliament at Delhi and submission of Memorandum to Finance Minister/DFS

05.03.2025 : Serving strike notice on IBA, DFS and CLC

07.03.2025 : Evening time demonstration at centres

11.03.2025 : Demonstration at all Corporate/ Head Office/ Zonal/ Regional offices by respective affiliates .

17.03.2025 : Press Conference at all State Headquarters

21.03.2025 : Evening time Rally at major centres

22.03.2025 : Social Media Campaign including X handle

24/ 25 -03.2025 : TWO DAYS STRIKE FOR CONTINUOUS 48 HOURS

AIBEA TO GO ON AGITATION PATH :

Dated 18.01.2025 : Office bearers of the leading Banking trade union AIBEA ( All India Bank Employees Association ) met recently in Kolkatta and decide to launch agitations to press for their following demands :

• Adequate recruitment of permanent employees in all Banks in clerical and sub staff cadre.

• Stop outsourcing the regular and perennial jobs in Banks.

• Introduce 5 Days Working per week.

• Ensure safety of bank employees against increasing attacks and abuses by customers

• Absorb temporary employees in the permanent vacancies

• Stop interference by DFS on bilateral service conditions and stop micro- management of Banks by DFS. Ensure autonomy of PSBs

• Fill up Workman/Officer Director posts in PSBs.

· Resolve Residual issues without further delay.

· Create a separate cadre for BC/Bank Mitras with uniform service conditions.

• Extend Old Pension Scheme to all employees covered by NPS.

• Amend Gratuity Act to increase the ceiling to Rs 25 lacs on the lines of Scheme for govt employees along with exemption from income tax.

• Do not recover income tax on staff benefits given on concessional terms The meeting decided that all these issues should be campaigned and explained amongst all our members so that their participation in the agitational programmes and strike actions will be maximised.

The meeting decided to finalise the agitational programmes and strike dates looking to ensuing Budget Session of the Parliament in Feb. -March- April, 2025 and also in consultation with other Unions who are willing to forge a joint action on these issues. Meeting also decided that efforts to be taken to undertake the programme under the banner of UFBU.

BANK OFFICERS ASSOCIATION PROPOSES STRIKE IN FEBRUARY :

Date 11.01.2025: All India Bank Officer Confederation ( AIBOC ), a leading bank officers association in India, has proposed to go on a two-day strike tentatively on February 24th and 25th, 2025, in support of their various demands. Their demands include

Adequate recruitment of staff in all the cadres

Implementation of 5 days banking

Withdrawal of DFS instruction on PLI scheme

Resolution of pending residual issues of bipartite agreements

Appointment of workmen / officers directors

Safety measures against assault / attack by the customers

Increase gratuity limit to Rs 25 lakhs.

Source : AIBOC CIRCULAR

PUBLIC SECTOR BANKS STAFF STRENGTH SHRINKS :

Dated 06.01.2025 : The recent RBI Report on Trend and Progress of Banking in India 2023-24 highlights the following key points regarding bank staff numbers:

Private Sector Dominance: Private sector banks have significantly increased their workforce in the past decade, surpassing public sector banks in terms of employee strength . The head count in private sector banks have increased from 303, 856 in FY 2014 to 846, 530 in FY 2024 . These banks have seen significant business growth and have also increased their workforce. This suggests that business growth per person might be higher in private-sector banks compared to public-sector banks. Private sector banks have witnessed a substantial increase in the “officers” category of employees. The report notes high employee attrition rates in some private sector banks and small finance banks, posing potential operational risks.

Public Sector Banks: The head count in public sector banks have declined from 842, 813 from FY 2024 to 746, 649 in FY 2024 . While they have shown strong business growth in recent years, their workforce has been declining. This could potentially lead to higher business growth per person, but it’s important to consider the potential impact on employee workload and productivity. Public sector banks have seen a decline in employees, particularly in the “clerks” category.

Report tells that the reduction in the employee strength of the state-owned banks has been in the “clerks” category while the private sector banks have added employees in the “officers” category. Since FY14, employees in the “clerks” category of public sector banks have decreased from 333,583 to 246,965. In contrast, employees in the “officers” category of private banks have gone up from 225,805 in FY14 to 796,809 in FY24

To read RBI’s report , CLICK HERE

Why decline in PSB HEADCOUNT ?

The decline in Public Sector Bank (PSB) employee strength can be attributed to several factors:

Mergers and Consolidations: The Indian government has undertaken several rounds of mergers and consolidations among PSBs. This has led to the reduction of redundant positions and streamlining of operations

Automation and Technology: PSBs have been investing heavily in technology and automation. This has led to the automation of many routine tasks, reducing the need for manual labor.

Focus on Efficiency: PSBs are under pressure to improve their efficiency and profitability. Reducing employee costs is seen as a way to achieve this goal.

Retirement and Attrition: Natural attrition due to retirements and resignations has also contributed to the decline in employee strength.

Shifting Focus: PSBs are increasingly focusing on digital banking and other new-age banking services. This requires a different skill set and may lead to a reduction in traditional roles.

It’s important to note that while the number of employees has declined, PSBs are still major employers in India. They are also investing in training and development to equip their employees with the skills needed for the changing banking landscape.

The leading trade union in the banking industry All India Bank Employees Association ( AIBEA ) has demanded an increase in recruitments of PSB Staff .

It’s also to be noted that some Public Sector Banks (PSBs) have undertaken recruitment drives in recent times to improve their staff strength .

State Bank of India (SBI): Recently announced the recruitment of 600 Probationary Officers (POs).

Bank of Baroda: Announced the recruitment of 1267 Specialist Officers (SOs).

Other PSBs: Many other PSBs have also conducted recruitment drives for various positions, including clerks, specialist officers, and other roles.

These recruitment drives indicate that PSBs are still hiring to meet their operational requirements and address the evolving needs of the banking sector.

TOO LITTLE SALARY HIKE FOR TOO LONG :

Inflation adjusted salary turns negative for Indian workers Including BFSI workers

Dated 17.12.2024 : A recent unpublished , but reported by various media outlets , survey report prepared by M/S Quess corp Ltd for FKCCI suggests that wages of Indian workers have grown very nominally during five period of 2019 to 2023 . If we adjust for the inflation rates during the same five year period , salary growth becomes negative .

The report suggests that the compound annual growth of Indian workers was a mere 0.8 % while annual inflation rates were much higher during the period. The retail infltion was 4.8 % in 2019-20 , 6.2% in 2020-21 , 5.5 % in 2021-22 , 6.7 % in 2022-23 & 5.4 % in 2023-24 . Compared to the inflation rates , Wages grew total of mere 2.8 % for the entire period in BFSI sector ( Banking , Financial services & Insurance ) . Growth in wages in other sectors was also subdued . EMPI sector growth was lowest at 0.8 % during the five year period . In other sectors , growth of wages was 4 % in IT industry , FMCG 5.4 % , Logistics 4.2 % and retail wage growth was 3.7 % for the five year period .

The nominal growth of wages which has resulted in poor demand is said to be one of the reasons for subdued GDP growth of the econmy .

In contrast to the low growth of wages for employees , profits for the corporates grew four times for the private corporates during the four year period .

AIBEA OPPOSES NEW PERFORMANCE LINKED INCENTIVE SCHEME MOOTED BY THE FINANCE MINISTRY

Dated 24.11.2024 : It is reported that the Finance Ministry has instructed the State Bank of India and other nationalized banks to formulate board-approved policies under the framework of a new scheme for grantng Performance Linked Incentives (PLI) for Whole Time Directors, which will also extends to officers from Scale IV to Scale VIII. .

The Performance Linked Incentive for employees (clerical and subordinate staff) and officers (Scale I to Scale VII) has already been determined and settled through bilateral agreements between the Indian Banks’ Association (IBA) and United Forum of Bank Unions consisting of all Employees Unions and Officers Associations at the industry level. These agreements, based on mandates provided by member banks’ boards, also encompass officers in Scale VIII.

In view of the bilateral agreement already settled , AIBEA is opposing the new revised scheme mooted by the Finance Ministry . AIBEA contends that the selective approach of the government to incentivise only officers from Scale IV to VIII (counting less than 5% of the total workforce), while excluding over 95% of employees who primarily drive business at the field level, is inequitable.

AIBEA contends ” The current directive, which prescribes how senior officers should perform and prioritize their work to earn incentives, surely infringes upon the autonomy of public sector banks. It disregards their governance structures and imposes centralized control, which could stifle strategic decision-making aligned with individual banks’ unique challenges. Such micro-management by the government sets a dangerous precedence, undermining the independence of functions of the boards of the public sector banks. “

Further AIBEA questions introduction of Individual incentive as it would result into everyone pressuring the system for individual gain.

Hence , in a letter written to the finance ministry has urged the Department of Financial Services to respect the autonomy of public sector banks and entrust the Indian Banks’ Association, along with bank managements, with the responsibility to design compensation mechanisms taking the Unions/ Associations along as hitherto.

To read the f letter of AIBEA addressed to the secretary DFS , CLICK HERE

BANKERS DA TO INCREASE BY 2.63 % FROM NOVEMBER 2024

Dated 04 .11.2024 : The Dearness Allowance on salary of bankers is set for an increase of 2.63 % from November 2024, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 19.83 % .

As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 . The average points for July 2024 to September 2024 is 142.87 and it works out to be 19.83 % . Earlier DA was 17.20 % .

The new DA rate is valid up to January 2025 and will be reviewed thereafter.

AIBEA OPPOSES NEW REVIEW SYSTEM OF BANK EMPLOYEES / OFFICERS

Dated 28.10.2024 : It is reported that the Finance Ministry has instructed the State Bank of India and other nationalized banks to undertake periodic review of the performance of employees and officers and prematurely retire those found to be inefficient.

According to these instructions, such a review of performance will be applicable as follows :

STATE BANK OF INDIA :

A. Officers: 50 years of age or 25 years of service

B. Sub -Staff and Clerks : 58 years and above

NATIONALIZED BANKS :

A. Officers : 55 years of age or 30 years of service

B. Sub -Staff and Clerks : 57 years and above

The instruction is to review the performance and efficiency of the above-covered officers and employees and RETIRE THEM PREMATURELY in the public interest if their performance and efficiency is not to the satisfaction of the management. An Officer can be prematurely retired by giving 3 months’ Notice or pay in lieu thereof. A clerk or sub staff can be prematurely retired by giving 2 months Notice.

Banks have been instructed to undertake this review process every month and send the Report to the Government regarding the number of officers and employees reviewed and the number of persons who retired prematurely after the review.

The leading bank trade union ALL INDIA BANK EMPLOYEES ASSOCIATION ( AIBEA ) has opposed the move of the Government of India and has contended that the present provisions in the Bipartite Settlements/Awards/Officers Service Regulations to take action against any employee or officer wherever warranted. is sufficient .

Source : AIBEA CIRCULAR

AIBEA WITHDRAWS STRIKE CALL :

Dated 24.08.2024 : As the management of Bank of India have agreed not to take disciplinary actions against the office bearers / members of AIBEA ( All India Bank Employees union ) , the union has called off its strike call on the Wednesday 28th, August 2024

The grouse of the union against the management of Bank of India was that 13 office bearers of Bank of India Staff Union , Kerala had been suspended .

For Circular issued by AIBEA on the matter , CLICK HERE

AIBEA CALLS FOR A DAY’S BANK STRIKE :

Dated 20.08.2024 : The leading trade union of bank employees , AIBEA ( All India Bank Employees union ) has called for an all India Bankers strike on the Wednesday 28th, August 2024 to protest against the harassment of their members of Bank of India Staff Union , Kerala .

The grouse of the union against the management of Bank of India is that 13 office bearers of Bank of India Staff Union , Kerala have been suspended and disciplinary action taken against them quoting Gross indiscipline .

It is reported that other trade unions of banks like AIBOC , NCBE , BEFI , AIBIA , INBOC and INBEF have supported the strike call of AIBEA .

BANKERS DA TO INCREASE FROM AUGUST 2024

Dated 06.08.2024 : The salary of bankers is set for an enhancement from the month of August 2024 , as the Dearness Allowance ( DA ) payable to bank employees / officers has increased by 1.23 points .

As per 12th bipartite settlement , DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .The earlier average was points up for the quarter ended March 2024 was 139.00 and the average index points for the quarter ending June 2024 is 140.23 points and hence an increase of 1.23 points . Accordingly , new DA rate will be 17.20 % .

The sub- staff DA is set for an increase between Rs 313.87 to Rs 829.04 while clerical staff can expect a hike between Rs 384.66 to Rs 1,472.43

To read AIBEA CIRCULAR on the subject , CLICK HERE

BANKERS DA TO MARGINALLY INCREASE FROM MAY 2024

Dated 10 .06.2024 : The salary of bankers is set for a marginal enhancement from the month of May 2024 , as the Dearness Allowance ( DA ) payable to bank employees / officers has increased by 0.24 points .

As per 12th bipartite settlement , DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The earlier average was points up for the quarter ended December 2023 was 138.76 and the average index points for the quarter ending March 2024 is 139 points and hence an increase of 0.24 points . Accordingly , new DA rate will be 15.97 % .

The sub- staff DA is set for an increase between Rs 61.24 to Rs 161.76 while clerical staff can expect a hike between Rs 75.96 to Rs 287.30

To read AIBEA CIRCULAR on the subject , CLICK HERE

CENTRAL GOVERNMENT RAISES GRATUITY LIMIT FOR ITS EMPLOYEES :

Dated 01.06.2024 : On the recommendation of the Seventh Central Pay Commission , the maximum limit of retirement Gratuity and Death Gratuity under the Central Civil Services is increased by 25% i.e.from Rs 20.00 Lakh to Rs 25.00 Lakh,with effect from 1 January 2024.

Department of Pension &Pensioners’ Welfare of Government of India has issued an office memorandum dated 30.05.2024 and has asked all ministries to being it to the notice of Controller of Accounts/Pay and Accounts Offices and attached or subordinate offices under them.

To read the Office Memorandum dated 30.05.2024 , CLICK HERE

BENEFITS UNDER INTEREST FREE LOANS TO BANK STAFF ARE TAXABLE : SUPREME COURT

Dated 09.05.2024 : In a land mark judgment , A bench of Justices Sanjiv Khanna and Dipankar Datta have said the that interest-free or concessional loans provided by banks to their staff has to be treated as fringe benefits or amenities and are subject to taxation .

The bench also noted that the fixation of SBI’s rate of interest as the benchmark is neither an arbitrary nor unequal exercise of power, as the rule-making authority has not treated unequal as equals.

Section 17(2)(viii) of the Income Tax Act, 1961 and Rule 3(7)(i) of the Income Tax Rules, 1962 were challenged by various bank employees unions and officers associations . They had argued that the said legislations were arbitrary and actual interest rate charged by the banks to its customers had to be taken as benchmark .

Banks generally extend various loans like housing loans , educational loans and Festival advance at concessional interest rates .

Complete details can be had in the link in the article of Times of India attached Source : Various media houses

DEFINITION OF A FAMILY FOR BANK EMPLOYEES :

Dated 24.03.2024 : In the recently signed bipartite agreement between UFBU and IBA , the definition of a family for bank staff is as follows :

FAMILY of a Bank employee shall include the following family members :

i Employee’s spouse,ii. Wholly dependent unmarried children (including step children and legally adopted children)

iii. wholly dependent physically and mentally challenged brothers I sisters with 40% or more disability,iv. widowed daughters and dependent divorced I separated daughters,

v. sisters including unmarried/ divorced/ abandoned or separated from husband/ widowed sisters,vi. parents wholly dependent on the employee.

In the case of physically and mentally challenged children irrespective of age, they shall be construed as dependents even after their marriage subject to however fulfilling the income criteria for dependent .

Dependent’s income criteria :

Wholly dependent family member shall mean such member of the family having a monthly income not exceeding Rs.18,000/ (It was Rs. 12,000 under 11th BPS). If the monthly income of the parents exceeds Rs.18,000/- or the aggregate of monthly income of both the parents exceeds Rs.18,000/-, both the parents shall not be considered as wholly dependent on the employee.

Note: For the purpose of medical expenses reimbursement scheme, and Leave Fare Concession, for all employees, any two of the dependent father, mother, father-in law, mother- in-law shall be covered. The employee will have the choice to substitute either of the dependents or both once in a calendar year.

The above criteria for a family member and dependent family member will be applied only

1) for the purpose of availing LFC and2)for reimbursement hospitalization expenses/coverage under the Medical Insurance Policy,

IMPROVEMENT IN LEAVE RULES

Dated 16.03.2024 : In the recently signed bipartite settlement , following changes / improvements have been made under the leave rules for the staff :

1. When leave is applied by an employee and the same is declined by the Manager, the valid reason for such decline of leave will be informed to the employee so that the employee can take up the matter with higher authorities or with the Union.2. 2 days of Casual leave may be availed for half a day on 4 occasions in a year out of which 2 occasions would be in the morning and 2 occasions in the afternoon. Note: Casual Leave under this category can be availed after applying 24 hours in advance.

3.A single male parent can avail sick leave for the sickness of his child of 8 years and below by production of medical certificate about child’s sickness.4. Employees can avail sick leave for the sickness of their Special Child of 15 years and below for a maximum period of 10 days in a calendar year by production of medical certificate about child’s sickness.

5. Women employees shall be allowed to take one day Sick Leave per month without production of any medical certificate.6. In case of employees of the age of 58 years and above, if wife or husband falls sick and hospitalized in another centre than the place of work, he/she need not avail privilege leave and they will be granted sick leave (maximum of 30 days in a calendar year). This will help the employee to conserve his/her privilege leave which can be encashed at the time of retirement.

7. Employees shall be granted sick leave at the rate of one month for each year of service subject to a maximum of 720 days. (24 years x 30 days). (now it is 540 days for 18 years, then another 90 days after 24 years and another 90 days after 30 years, i.e. 720 days in 33 years)8. In case of delivery of more than two children in one single delivery, Maternity Leave shall be granted upto 12 months continuously.

9. Maternity Leave shall be granted to a female employee for a maximum period of 9 months, for legally adopting a child who is below one year of age.10. Maternity Leave will be granted for In vitro fertility (IVF) treatment subject

to production of medical certificate, within the overall limit of 12 months.11. Special maternity leave upto 60 days shall be granted in case of still born or death of the infant within 28 days of birth.

12. Employees shall be granted Bereavement Leave on the demise of the family members (spouse, children, parents and parent-in-law) and number of days of such leave shall be decided by each Bank at their level.13. For calculating privilege leave, casual leave and mandatory leave will not be excluded.

14. Principal Office bearers of All India Workmen Unions/Associations (AIBEA, NCBE, etc) shall be granted Special Leave upto 25 days in a calendar year. 15. Advance notice of 10 days for availing privilege leave will be waived for office bearers and Executive Committee members of a registered trade union.16. Employees who are Defence Representatives in departmental enquiry proceedings will be granted one day special leave for the purpose of preparing the defence submissions of an employee. Such special leave shall be granted for a maximum of ten occasions in a year.

17. Leave Encashment: Accumulated privilege leave can be encashed upto 255 days now 240 days) at the time of retirement or upon unfortunate death of an employee while in service.18. Introduction of Leave Bank Scheme: Looking to the contingencies where some of the employees get affected with very major ailments like cancer, cerebral stroke, paralysis, major organ transplantation, end stage liver disease, kidney failure, etc., or on account of major accidents, where the hospitalization, treatment and convalescence is prolonged and where in such cases, employees are absent from office on medical grounds for prolonged periods and have exhausted all the leave to their credit and hence are under compulsion to seek grant of extraordinary leave without pay, it has been agreed to evolve a staff welfare scheme under which provision would be made for voluntary encashment of Privilege Leave by the employees and the monetized value of such leave would be pooled under a Leave Bank system in each Bank out of which, special leave would be sanctioned to the employees affected by such contingencies. A Scheme would be formulated within 90 days.

Source : AIBEA CIRCULAR

NO CHANGE IN BANKERS DA

Dated 01 .02.2024 : No change in bankers DA as the average consumer index points have decreased in the quarter ending December 2023 to 9122.33 points from earlier average of 9124.51 points . Accordingly the DA slabs have remained same at 693 .

The next review of DA will be for the month of May 2024 salary

To read AIBEA CIRCULAR on the subject , CLICK HERE

AIBEA WITHDRAWS STRIKE NOTICE :

Dated 18.01.2024 : AIBEA had planned strikes on 19th & 20th, January 2024 to press for their demand for stopping outsourcing of manpower and more recruitment of staff in banks . it had also issued strike notice .

A reconciliation meeting between AIBEA and bank managements was initiated by the chief labour commissioner ( CLC ) , Delhi yesterday . In the meeting IBA reiterated that the above issues are part of charter of demands submitted by the unions and it would be discussed in the on-going 12 th bipartite negotiations . Further IBA will issue circulars to banks to maintain status quo in the matter of outsourcing .

In view of te above development , AIBEA has decided to withdraw the notice / call for the strike .

STRIKE CALL BY CENTRAL BANK OF INDIA EMPLOYEES / OFFICERS WITHDRAWN :

Date 19.12.2023 : Various employee unions and officers associations of Central Bank of India affiliated to AIBEA , AIBOA , INBEF , BEFI & NOBW had given a strike call on 26th , December 2023 pressing their demands for stopping harassment of officers and violation of agreements .

Yesterday discussion between unions and management representatives of CBI took place in the Dy CLC office on all the issues mentioned Strike notice given by the trade unions and an Understanding has been reached . In view of the developments Unions have withdrawn the proposed Strike on 26th December .

BANK EMPLOYEES STRIKE DEFERRED :

Dated 25.11.2023 : After AIBEA served notice of strike , a reconciliation meeting between AIBEA and bank managements was initiated by the chief labour commissioner ( CLC ) , Delhi . CLC advised the banks that ID act and settlements should not be violated by banks.

With regard to outsourcing of man power , managements agreed to maintain status quo on outsourcing. With regard to demand for recruitment of adequate staff , it was agreed that manpower policy will be discussed at IBA level. Hence AIBEA agreed to defer the bankwise and statewise strikes and continue the discussions. However all India Strike on 19 and 20 January 2024 is not withdrawn .

Next Conciliation meeting with CLC is scheduled on 12th January 2024 .

To read AIBEA circular on the issue , CLICK HERE

BANKERS DA SET FOR AN INCREASE FROM NOVEMBER 2023

Dated 31 .10.2023 : The salary of bankers is set for enhancement from the month of November 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from November 2023 to January 2024 will go up by 61 slabs .

The average consumer index points have increased in the quarter ending September 2023 to 9124.51 points from earlier average of 8881.28 points . Accordingly the DA slabs have gone up by 61 slabs from 632 slabs to 693 . DA as % of Basic pay will increase by 2.52 % from 44.24 % to 48.51 % .

To read AIBEA CIRCULAR on the subject , CLICK HERE IBA Circular dated 01.11.2023

BANKERS DA SET FOR AN INCREASE FROM AUGUST 2023

Dated 31 .07.2023 : The salary of bankers is set for enhancement from the month of August 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from August 2023 to October 2023 will go up by 36 slabs .

The average consumer index points have increased in the quarter ending June 2023 to 8881.28 points from earlier average of 8736 points . Accordingly the DA slabs have gone up by 36 slabs from 596 slabs to 632 . DA as % of Basic pay will increase by 2.52 % from 41.72 % to 44.24 % .

To read AIBEA circular , CLICK HERE

Official circular is yet to be issued .

BANKERS DA SET FOR A SLIGHT INCREASE FROM MAY 2023

Dated 29 .04.2023 : The salary of bankers is set for enhancement from the month of May 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from May 2023 to July 2023 will go up by 8 slabs .

The average consumer index points have increased in the quarter ending March 2023 to 8763 points from earlier average of 8704 points . Accordingly the DA slabs have gone up by 8 slabs from 588 slabs to 596 . DA as % of Basic pay will increase by 0.56 % from 41.16 % to 41.72 % .

To read AIBEA circular , CLICK HERE

BANKERS DA SET FOR A INCREASE FROM FEBRUARY 2023

Dated 31 .01.2023 : The salary of bankers is set for enhancement from the month of February 2023 , as the Dearness Allowance ( DA ) payable to bank employees / officers from February 2023 to April 2023 will go up by 32 slabs .

The average consumer index points have increased in the quarter ending December 2022 to 8705 points from earlier average of 8576.69 points . Accordingly the DA slabs have gone up by 32 slabs from 556 slabs to 588 . DA as % of Basic pay will increase by 2.10 % from 38.92 % to 41.16 % .

Official circular is yet to be issued .

NEWS FOR BANKERS

IMPORTANT BANKERS NEWS

EXCLUSIVE NEWS FOR BANKERS BANK PENSIONERS NEWS /BANK RETIREES NEWS

BANKERS DA TO DECREASE BY 1.23 %

Dated 01.05.2025 : The Dearness Allowance on salary of bankers is set for a decrease of 1.23 % from May 2025, as the Dearness Allowance ( DA ) payable to bank employees/officers has decreased to 19.97 % . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to July 2025 and will be reviewed thereafter .

To read AIBEA circular on the subject , CLICK HERE

PROPOSED BANKERS ‘ STRIKE DEFERRED

Date 21.03.2025: The adjourned conciliation meeting between UFBU , Banks and CLC took place today from morning. There was serious discussion on demands put up by UFBU.. Joint secretary of DFS spoke on video call to the participating members and informed about the positive discussion FM and DFS secretary had on the issue of 5 Day banking. Iba proposed to further discuss issues like recruitment and PLI and other issues. CLC informed that he will directly monitor the issues including implementation of 5 days banking. The meeting has been adjourned to be held again in the third week of April. In view of this positive development UFBU felt it necessary to postpone the proposed strike on 24th and 25th , March 2025 for a month or two. Hence proposed strike on 24th and 25th is postponed.

AIBEA OPPOSES NEW PLI FORMULA FOR THE SENIOR OFFICERS :

Dated 20.03.2025 : It is reported that the DFS, Finance Ministry had sent an unilateral modification of the Performance Linked Incentive Scheme ( PLI ) in November 2024 applicable to Scale IV officers and above. Earlier they were part of the Bilateral agreement signed between UFBU and IBA which was based on the collective performance of the Bank .

Now for the senior officers, PLI eligibility will depend up on the individual performance and the maximum eligible amount will be as follows :

For scale IV officers , 70% of Annual Basic Pay i.e. 255 days of Basic pay i.e. Rs. 11.75 lacs .

For scale V & VI officers, 80 % Annual Basic Pay i.e. 292 days of Basic pay i.e. Rs. 14.40 lacs

For scale VII officers , 90% Annual Basic Pay i.e. 328 days of Basic pay i.e. Rs. 22.50 lacs .

The new modified formula advised by DFS offers a huge jump in incentive amount to the senior officers , but based on individual performance .Hence some senior officers may not be eligible for any incentive , and AIBEA is opposing the scheme as they find the scheme

It is unilateral scheme by Government

It is violation of bilateral scheme agreed by IBA

It is nIt is discriminatory because majority will get lesser PLI and small section will get very huge PLI.ot inclusive, 1/5th of Scale IV-VIII officers will not be covered even if they are performers.,

It is discriminatory because majority will get lesser PLI and small section will get very huge PLI.

The Scheme provides that if the reputation of a Bank is affected say due to some fraud by outsides, the entire Bank will be ineligible for PLI and all Scale IV and above will not be paid PLI even though all of them are performers.

It is against basic stand of UFBU that collective performance should be the basis and not individual performance.

To read AIBEA Circular on the subject , CLICK HERE

PROPOSED BANKERS ‘ STRIKE : Reconciliation Fails

Date 19.03.2025: United Forum of Bank Unions . group of bank employees unions and officers associations, has called for a two days 48 hours continuous strike on 24th and 25th , March 2025 in support of their various demands. as mentioned here .

Adequate recruitment in all cadres, regularise all temporary employees

Implementation of 5 days banking

Withdrawal of DFS instruction on PLI scheme

Resolution of pending residual issues of bipartite agreements

Appointment of workmen / officers directors

Safety measures against assault / attack by the customers

Increase gratuity limit to Rs 25 lakhs.

Do not recover income tax on staff welfare benefits given to employees and officers on concessional terms. Managements to bear the same.

Maintain a minimum of 51% of Equity Capital in IDBI Bank by Government .

Based on the strike notice served by UFBU, the Chief Labour Commissioner, Ministry of Labour Govt. of India had called for a conciliation meeting in Delhi yesterday morning. UFBU was represented by all the constituent Unions. Representatives of IBA, DFS and all the Banks were present.IBA, DFS, and bank managements were present . Meeting discussed the strike issues . However there was no positive outcome on the issues , Hence UFBU has advised all their members to go ahead with the proposed strike

UFBU is an umbrella body of 9 Bank unions AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO which represents bank employees unions and bank officers associations.

BANKERS DA TO INCREASE BY 1.37 % FROM FEBRUARY 2025

Dated 18 .02.2025 : The Dearness Allowance on salary of bankers is set for an increase of 1.37 % from February 2025, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 21.20% . As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 .

The new DA rate is valid up to April 2025 and will be reviewed thereafter

To read AIBEA circular on the subject , CLICK HERE

BANKERS TO GO ON STRIKE IN MARCH :

Date 08.02 .2025: United Forum of Bank Unions . group of bank employees unions and officers associations, has called for an agitational programme culminating in two days 48 hours continuous strike in support of their various demands. . Proposed strike dates are 24th and 25th , March 2025 .

The proposed agitational programme includes :

14.02.2025 : Evening time demonstration at major centres

16.02.2025 onward : Poster campaign at all branches/offices/Rly.stn/Bus stand/ public places

21.02.2025 : Evening time demonstration at major centres and District headquarters .

23.02.2025 : Social media campaign

28.02.2025 : Badge wearing

03.03.2025 : Dharna before Parliament at Delhi and submission of Memorandum to Finance Minister/DFS

05.03.2025 : Serving strike notice on IBA, DFS and CLC

07.03.2025 : Evening time demonstration at centres

11.03.2025 : Demonstration at all Corporate/ Head Office/ Zonal/ Regional offices by respective affiliates .

17.03.2025 : Press Conference at all State Headquarters

21.03.2025 : Evening time Rally at major centres

22.03.2025 : Social Media Campaign including X handle

24/ 25 -03.2025 : TWO DAYS STRIKE FOR CONTINUOUS 48 HOURS

AIBEA TO GO ON AGITATION PATH :

Dated 18.01.2025 : Office bearers of the leading Banking trade union AIBEA ( All India Bank Employees Association ) met recently in Kolkatta and decide to launch agitations to press for their following demands :

• Adequate recruitment of permanent employees in all Banks in clerical and sub staff cadre.

• Stop outsourcing the regular and perennial jobs in Banks.

• Introduce 5 Days Working per week.

• Ensure safety of bank employees against increasing attacks and abuses by customers

• Absorb temporary employees in the permanent vacancies

• Stop interference by DFS on bilateral service conditions and stop micro- management of Banks by DFS. Ensure autonomy of PSBs

• Fill up Workman/Officer Director posts in PSBs.

· Resolve Residual issues without further delay.

· Create a separate cadre for BC/Bank Mitras with uniform service conditions.

• Extend Old Pension Scheme to all employees covered by NPS.

• Amend Gratuity Act to increase the ceiling to Rs 25 lacs on the lines of Scheme for govt employees along with exemption from income tax.

• Do not recover income tax on staff benefits given on concessional terms The meeting decided that all these issues should be campaigned and explained amongst all our members so that their participation in the agitational programmes and strike actions will be maximised.

The meeting decided to finalise the agitational programmes and strike dates looking to ensuing Budget Session of the Parliament in Feb. -March- April, 2025 and also in consultation with other Unions who are willing to forge a joint action on these issues. Meeting also decided that efforts to be taken to undertake the programme under the banner of UFBU.

BANK OFFICERS ASSOCIATION PROPOSES STRIKE IN FEBRUARY :

Date 11.01.2025: All India Bank Officer Confederation ( AIBOC ), a leading bank officers association in India, has proposed to go on a two-day strike tentatively on February 24th and 25th, 2025, in support of their various demands. Their demands include

Adequate recruitment of staff in all the cadres

Implementation of 5 days banking

Withdrawal of DFS instruction on PLI scheme

Resolution of pending residual issues of bipartite agreements

Appointment of workmen / officers directors

Safety measures against assault / attack by the customers

Increase gratuity limit to Rs 25 lakhs.

Source : AIBOC CIRCULAR

PUBLIC SECTOR BANKS STAFF STRENGTH SHRINKS :

Dated 06.01.2025 : The recent RBI Report on Trend and Progress of Banking in India 2023-24 highlights the following key points regarding bank staff numbers:

Private Sector Dominance: Private sector banks have significantly increased their workforce in the past decade, surpassing public sector banks in terms of employee strength . The head count in private sector banks have increased from 303, 856 in FY 2014 to 846, 530 in FY 2024 . These banks have seen significant business growth and have also increased their workforce. This suggests that business growth per person might be higher in private-sector banks compared to public-sector banks. Private sector banks have witnessed a substantial increase in the “officers” category of employees. The report notes high employee attrition rates in some private sector banks and small finance banks, posing potential operational risks.

Public Sector Banks: The head count in public sector banks have declined from 842, 813 from FY 2024 to 746, 649 in FY 2024 . While they have shown strong business growth in recent years, their workforce has been declining. This could potentially lead to higher business growth per person, but it’s important to consider the potential impact on employee workload and productivity. Public sector banks have seen a decline in employees, particularly in the “clerks” category.

Report tells that the reduction in the employee strength of the state-owned banks has been in the “clerks” category while the private sector banks have added employees in the “officers” category. Since FY14, employees in the “clerks” category of public sector banks have decreased from 333,583 to 246,965. In contrast, employees in the “officers” category of private banks have gone up from 225,805 in FY14 to 796,809 in FY24

To read RBI’s report , CLICK HERE

Why decline in PSB HEADCOUNT ?

The decline in Public Sector Bank (PSB) employee strength can be attributed to several factors:

Mergers and Consolidations: The Indian government has undertaken several rounds of mergers and consolidations among PSBs. This has led to the reduction of redundant positions and streamlining of operations

Automation and Technology: PSBs have been investing heavily in technology and automation. This has led to the automation of many routine tasks, reducing the need for manual labor.

Focus on Efficiency: PSBs are under pressure to improve their efficiency and profitability. Reducing employee costs is seen as a way to achieve this goal.

Retirement and Attrition: Natural attrition due to retirements and resignations has also contributed to the decline in employee strength.

Shifting Focus: PSBs are increasingly focusing on digital banking and other new-age banking services. This requires a different skill set and may lead to a reduction in traditional roles.

It’s important to note that while the number of employees has declined, PSBs are still major employers in India. They are also investing in training and development to equip their employees with the skills needed for the changing banking landscape.

The leading trade union in the banking industry All India Bank Employees Association ( AIBEA ) has demanded an increase in recruitments of PSB Staff .

It’s also to be noted that some Public Sector Banks (PSBs) have undertaken recruitment drives in recent times to improve their staff strength .

State Bank of India (SBI): Recently announced the recruitment of 600 Probationary Officers (POs).

Bank of Baroda: Announced the recruitment of 1267 Specialist Officers (SOs).

Other PSBs: Many other PSBs have also conducted recruitment drives for various positions, including clerks, specialist officers, and other roles.

These recruitment drives indicate that PSBs are still hiring to meet their operational requirements and address the evolving needs of the banking sector.

TOO LITTLE SALARY HIKE FOR TOO LONG :

Inflation adjusted salary turns negative for Indian workers Including BFSI workers

Dated 17.12.2024 : A recent unpublished , but reported by various media outlets , survey report prepared by M/S Quess corp Ltd for FKCCI suggests that wages of Indian workers have grown very nominally during five period of 2019 to 2023 . If we adjust for the inflation rates during the same five year period , salary growth becomes negative .

The report suggests that the compound annual growth of Indian workers was a mere 0.8 % while annual inflation rates were much higher during the period. The retail infltion was 4.8 % in 2019-20 , 6.2% in 2020-21 , 5.5 % in 2021-22 , 6.7 % in 2022-23 & 5.4 % in 2023-24 . Compared to the inflation rates , Wages grew total of mere 2.8 % for the entire period in BFSI sector ( Banking , Financial services & Insurance ) . Growth in wages in other sectors was also subdued . EMPI sector growth was lowest at 0.8 % during the five year period . In other sectors , growth of wages was 4 % in IT industry , FMCG 5.4 % , Logistics 4.2 % and retail wage growth was 3.7 % for the five year period .

The nominal growth of wages which has resulted in poor demand is said to be one of the reasons for subdued GDP growth of the econmy .

In contrast to the low growth of wages for employees , profits for the corporates grew four times for the private corporates during the four year period .

AIBEA OPPOSES NEW PERFORMANCE LINKED INCENTIVE SCHEME MOOTED BY THE FINANCE MINISTRY

Dated 24.11.2024 : It is reported that the Finance Ministry has instructed the State Bank of India and other nationalized banks to formulate board-approved policies under the framework of a new scheme for grantng Performance Linked Incentives (PLI) for Whole Time Directors, which will also extends to officers from Scale IV to Scale VIII. .

The Performance Linked Incentive for employees (clerical and subordinate staff) and officers (Scale I to Scale VII) has already been determined and settled through bilateral agreements between the Indian Banks’ Association (IBA) and United Forum of Bank Unions consisting of all Employees Unions and Officers Associations at the industry level. These agreements, based on mandates provided by member banks’ boards, also encompass officers in Scale VIII.

In view of the bilateral agreement already settled , AIBEA is opposing the new revised scheme mooted by the Finance Ministry . AIBEA contends that the selective approach of the government to incentivise only officers from Scale IV to VIII (counting less than 5% of the total workforce), while excluding over 95% of employees who primarily drive business at the field level, is inequitable.

AIBEA contends ” The current directive, which prescribes how senior officers should perform and prioritize their work to earn incentives, surely infringes upon the autonomy of public sector banks. It disregards their governance structures and imposes centralized control, which could stifle strategic decision-making aligned with individual banks’ unique challenges. Such micro-management by the government sets a dangerous precedence, undermining the independence of functions of the boards of the public sector banks. “

Further AIBEA questions introduction of Individual incentive as it would result into everyone pressuring the system for individual gain.

Hence , in a letter written to the finance ministry has urged the Department of Financial Services to respect the autonomy of public sector banks and entrust the Indian Banks’ Association, along with bank managements, with the responsibility to design compensation mechanisms taking the Unions/ Associations along as hitherto.

To read the f letter of AIBEA addressed to the secretary DFS , CLICK HERE

BANKERS DA TO INCREASE BY 2.63 % FROM NOVEMBER 2024

Dated 04 .11.2024 : The Dearness Allowance on salary of bankers is set for an increase of 2.63 % from November 2024, as the Dearness Allowance ( DA ) payable to bank employees/officers has increased to 19.83 % .

As per 12th bipartite settlement, DA rate will increase 1 % over 123.03 average points index CPI 2016 = 100 . The average points for July 2024 to September 2024 is 142.87 and it works out to be 19.83 % . Earlier DA was 17.20 % .

The new DA rate is valid up to January 2025 and will be reviewed thereafter.

AIBEA OPPOSES NEW REVIEW SYSTEM OF BANK EMPLOYEES / OFFICERS

Dated 28.10.2024 : It is reported that the Finance Ministry has instructed the State Bank of India and other nationalized banks to undertake periodic review of the performance of employees and officers and prematurely retire those found to be inefficient.

According to these instructions, such a review of performance will be applicable as follows :

STATE BANK OF INDIA :